The satellite launch provider just upsized its convertible debt offering. Is it raising capital to make an acquisition?

February 9, 2024

About a week ago, I suggested that Rocket Lab’s (Nasdaq: RKLB) $275 million convertible debt offering might be in lieu of an upcoming acquisition. The $288 million of cash on the company’s balance sheet seemed more than adequate to fully-cover the costs of scaling up its massive Neutron launch vehicle. The Neutron rocket would carry 30-times heavier payloads than Electron and could place into satellite constellations into orbit from just one single launch. It’s generally regarded to be the necessary future achievement that Rocket Lab need to launch its business into profitability.

And even though Rocket Lab was aggressively scaling up Neutron’s development through its new Mississippi-based facility, it was still only burning through around $45 million of cash every quarter. At its current run-rate, $288 million of cash should be enough to be fund Neutron’s scale-up for at least the next year and a half.

So what did Rocket Lab need the extra cash for?

I’ve been thinking about that, and I even chimed in again on the topic earlier today.

Rocket Lab’s stock is hovering near its 52-week low. This isn’t a very shareholder-friendly time to raise capital, especially convertible debt.

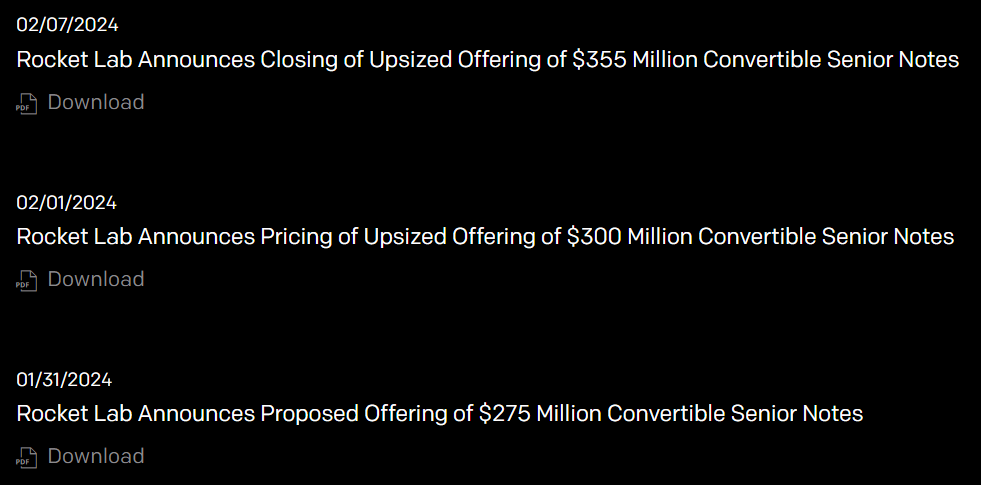

And even more interestingly, the company just increased that convertible debt offering by 30% — from $275 million when first announced at the end of January to $355 million just one week later.

Let’s talk a little bit about convertible debt. This is a relatively quick-and-easy way that companies can raise capital, and then agree to pay it back in stock rather than in cash. So even though $355 million would represent a full 18 months of revenue right now if paid back in cash, the value of the debt could also be paid back by converting the value to stock instead. Rocket Lab would dilute shareholders by doing so; but it would also be less financially burdensome for its balance sheet.

One other footnote is that Rocket Lab has also included a capped call option. This means that if the price of their shares is anywhere between $5.13 and $8.04 after three years, it retains the option of paying the debt back in cash to avoid the dilution. If the transaction were paid back entirely in equity, it would result in a maximum 29.6 million more shares being issued. Rocket Lab currently has 484 million outstanding shares; so this would represent around 6% dilution.

All of the above suggests that time is of the essence.

There’s likely something that’s time-sensitive in the works. Rocket Lab hasn’t discussed this publicly, but it perhaps needs to be fully-funded within the next month or two. Hence the convertible debt issuance.

So I believe this boils down to one of three things:

I personally think option #3 is the most likely. We’re heard Rocket Lab say it wants to be an end-to-end space company, and it’s already made several acquisitions in the past.

Now might be the time for every further consolidation. Looking forward to seeing if they make an announcement here within the next few months.

Already a 7investing member? Log in here.