The small-cap biotech company just reported excellent 4Q results. But there might be even more gains on the horizon.

February 26, 2024

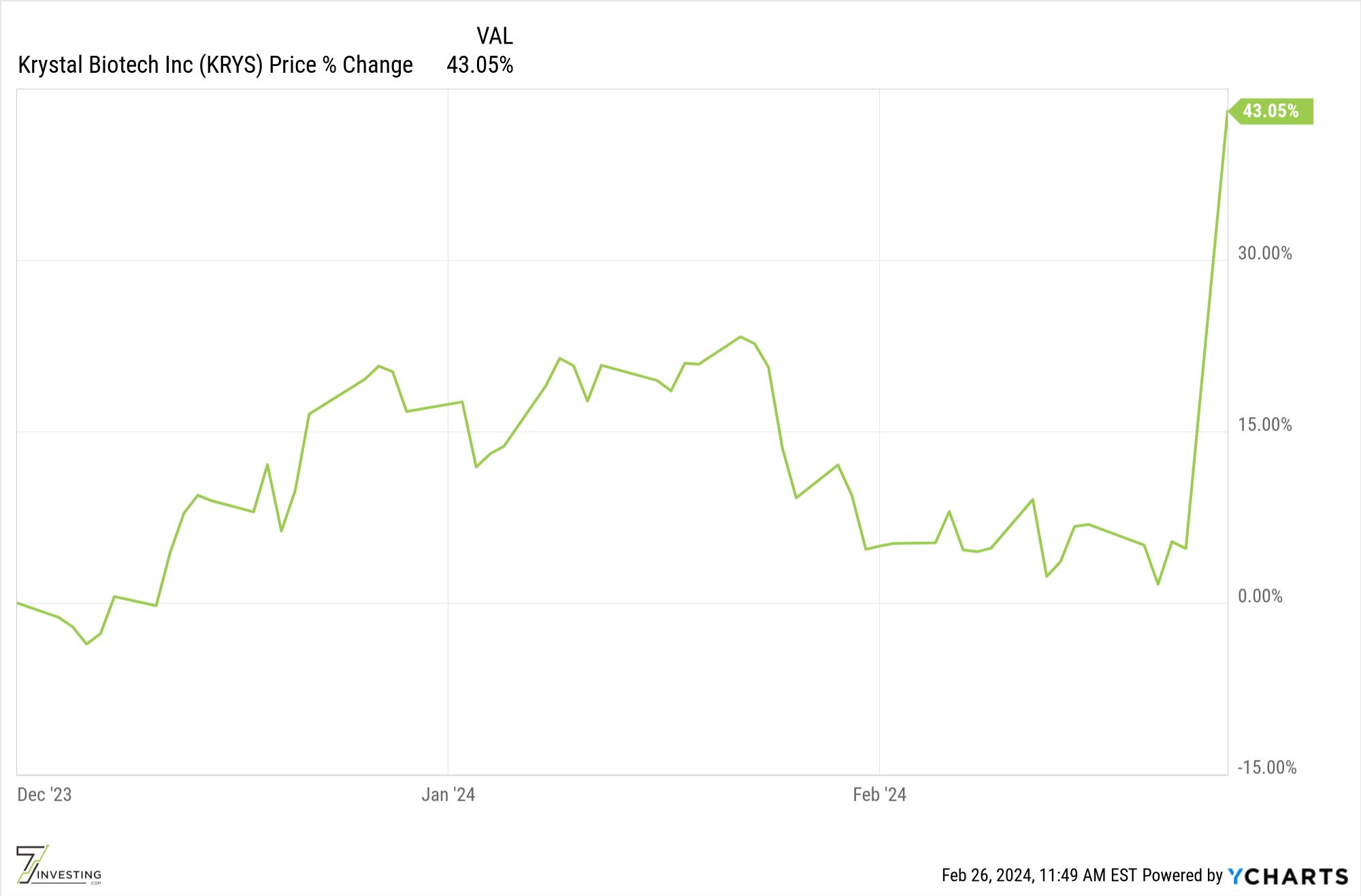

Krystal Biotech’s (Nasdaq: KRYS) stock is up 36% today, after a fantastic morning earnings report that showed Vyjuvek’s sales increased 390% quarter-over-quarter to $42 million in the most recent 4Q.

But this biotech party is still far from over. And this stock could still have quite a long runway ahead of it.

To see why, consider what I said about the company three months ago — when I recommended Krystal to be our 7investing Team Recommendation for December (it finished in third place, in the voting):

“Krystal Biotech just got approved by the FDA for its phase 3 drug for dystrophic epidermolysis bullosa (DEB). It’s a rare orphan disease of the skin, “butterfly skin.” They were using the HSV vector for drug delivery, to deliver their gene therapy exactly where it needed to go.

It just got approved and has a commercial name of Vyjuvek now. It’s already getting prescribed with patients. It only had $8.6 million in the third quarter, but that actually exceeded expectations.

And so the reason this one is so interesting right now is when you do get approval, normally it takes a little while to kind of get some traction.

Peak sales for a good biotech company are four or five years out or so. There was a consensus estimate that Krystal could do $163 million of commercial sales with Vyjuvek during its first year.

But there’s been some channel checks out there saying this is severely sandbagging and far too conservative. There’s some expectations that it might actually be closer to about $275 million. Which is a real disconnect.

And so with Krystal Biotech, drug delivery is going to be the next battleground for the pharmaceutical industry. This is one that’s got a really neat delivery vector that can carry the payload exactly where it needs to be for this rare disease that it worked on.

It’s already getting really good momentum right out of the gate. It seems to have a lot of checkmarks of what you want to see for a biotech company.”

Often times, there are opportunities for investors to find stocks where Wall Street’s institutional expectations are completely out-of-sync with reality. A company’s actual performance — at least or its publicly-stated forecast — can significantly outperform the expectations that are baked into its stock price. And when it does, you get fireworks and champagne bottles.

I think Krystal is going to generate a handsome operating profit from Vyjuvek, and it will use that to help fund its future pipeline where its novel drug delivery approach will also treat other diseases.

This one seems poised to have a monster upcoming year. Looking forward to seeing what 2024 has in store.

Please visit 7investing.com/subscribe to get started with 7investing for just $1 and to see all of our recommendations, our team discussions, and our real-time performance returns

Already a 7investing member? Log in here.