Netflix's stock has gone into a free fall. What should investors expect, going forward?

April 27, 2022

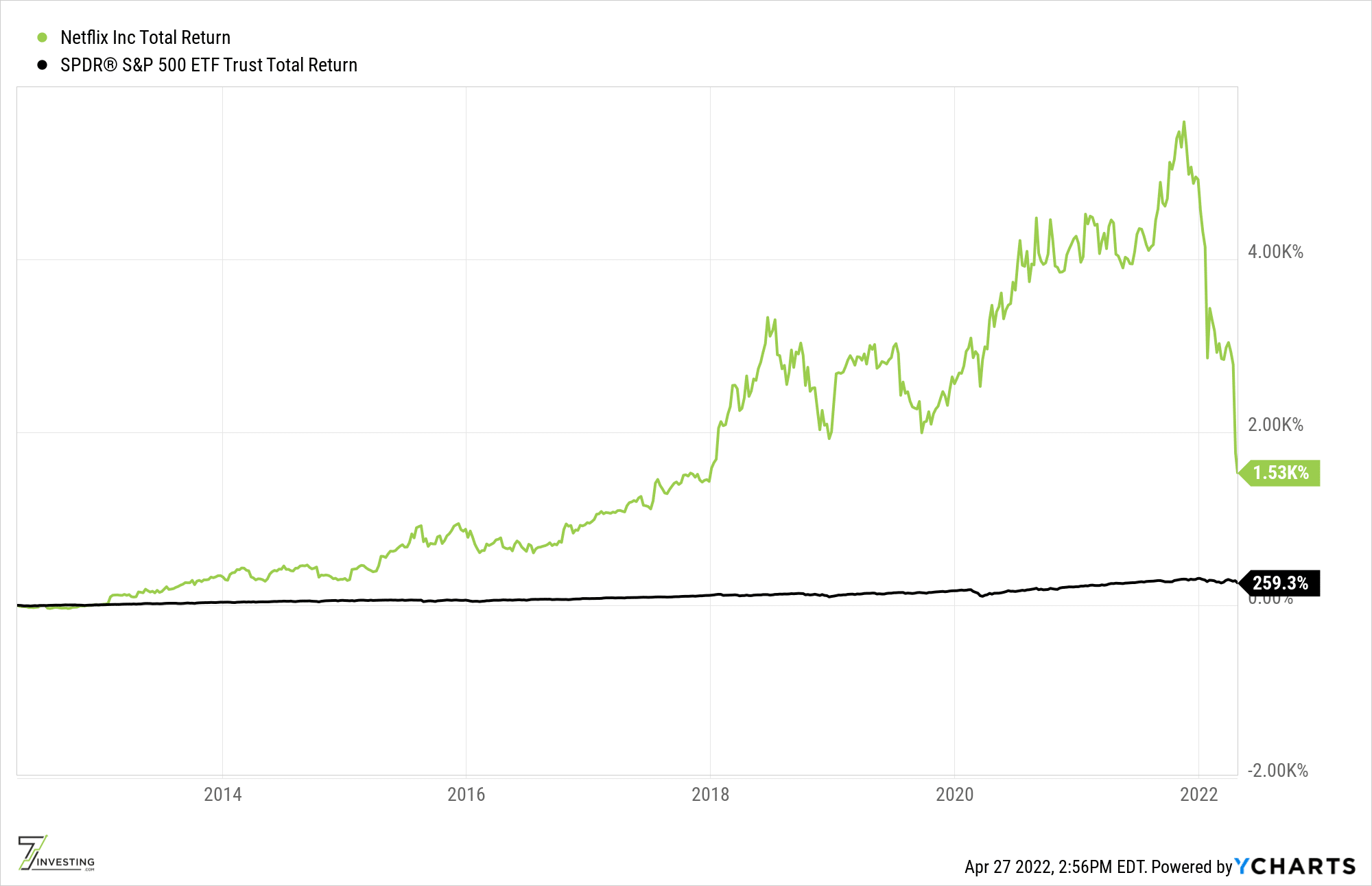

You’ve heard by now that Netflix (Nasdaq: NFLX) is in the middle of a free fall. Its stock fell more than 35% on Wednesday, April 20th and has been cut in half during the past month. This hasn’t been a great April for the company’s investors.

There are valid concerns about the business that are driving the selloff. Netflix reported a net loss of 200,000 subscribers in the most recent quarter, and expects to lose 2 million more in the upcoming quarter. Management cited households sharing accounts, a somewhat return-to-normalcy post-COVID, and increasing competition as growth headwinds. With some institutional investors also parting ways with their shares, there’s no shortage of pessimism that is weighing on Netflix’s stock.

Yet the stock market is continually forward-looking, and everything that happened earlier this week is in the past. At a recent price of $190, Netflix’s shares are selling at the lowest point that they’ve traded in more than four years. Investors must now determine if now is the time to be greedy and buy in to the world’s largest subscription-based digital streaming company.

There are a few things that Netflix immediately needs to fix.

For one, it estimates that in addition to its 222 million paying subscribers, 100 million more households are using others’ passwords to get Netflix for free in their own homes as well. The company hasn’t taken a concerted effort to get these freeloaders to pay up for access, and wants to initiate a ‘sharing plan’ to add family members to an existing plan for less money. I would personally recommend they start showing ads (more on that in a minute) to anyone logging in from outside of the primary account holder’s IP address. Either of these approaches would be a way to get incremental revenue from those who aren’t following its current terms and conditions.

Secondly, the company has vowed to double-down on quality original programming. This has been a sore subject, as we’ve recently spoken about how Netflix’s content is lagging in popularity when compared to the programming of HBO, Amazon (Nasdaq: AMZN), or even Apple (Nasdaq: AAPL). Even with efficient algorithms that power its recommendation engine, Netflix should invest more heavily in bigger bets, rather than trying too many things and seeing what sticks. Content isn’t an oil well. Investments aren’t a sure thing of future returns. Take the easier bets, even if they cost more upfront.

Netflix is digital streaming’s OG. The company was established in 1997, went public in 2002, and has two decades of operating history under its belt. But even with its tenured track record, there’s still an extremely long runway for even its most established markets like America to continue to embrace streaming.

Streaming still accounts for only 28.6% of America’s total TV time. That’s about the same ratio of the diameter of the moon as compared to the Earth. And within that sub-segment, Netflix controls 22% of America’s digital streaming hours (which is 6.4% of total TV hours). The cord-cutting trend is still very much a long-term trend, and the shift from linear to streaming should continue to benefit Netflix with new subscribers.

Yet there’s something else to the equation too, which is that Netflix is finally opening its eyes to the opportunity of advertising. Several other services — including Disney’s (NYSE: DIS) Hulu, ROKU (Nasdaq: ROKU) and many over-the-top streaming publishers — have already embraced programmatic advertising as an opportunity to reduce costs and subsidize their paid video-on-demand subscriptions.

Netflix has eschewed advertising for its entire history. Yet as the competition becomes more intense, advertising is a must-have for Netflix. Connected TV video advertisements can command prices of $100 or more per thousand impressions. For a company who controls more than 6% of America’s total TV time, this is a lot of money being left on the table. Netflix should take this opportunity to stand up and grab that.

And this is now a company that’s truly international:

| Region | Paying Subscribers | Annual Growth Rate | Avg Rev Per User |

| United States + Canada | 75 million | 0% | $14.91 |

| Europe | 73 million | 6.50% | $11.56 |

| Latin America | 40 million | 4% | $8.37 |

| Asia (ex-China) | 34 million | 25% | $9.21 |

Which brings us back to the original question. At a recent price of $190, Netflix’s market cap has dipped below $85 billion. It has 222 million paying subscribers across the globe and still has one of the smartest management teams in the room.

When we consider a market cap of $85 billion and those 222 million subscribers, Netflix the business is still commanding an intrinsic value of $382 per sub. That assumes a zero-growth scenario, which is fairly accurate based on where we stand in the most recent quarter.

That valuation doesn’t make sense for a subscription-only business. Netflix will need to execute on its promises of either winning new subs (or higher prices) with better programming or will need a new income stream from an advertising-supported tier.

Otherwise, if revenue remains simply a function of price and subscribers, today’s valuation still looks like an overpriced ticket for a re-run based upon Netflix’s former glory.

Already a 7investing member? Log in here.