NextEra Energy's stock has struggled in 2023 due to a difficult macroeconomy. Now yielding 3.3%, is it an opportunity for investors?

October 17, 2023

NextEra Energy (NYSE: NEE) is one company’s who’s charged up about powering America’s renewable future.

NextEra is North America’s largest electric utility. It generates 58 GW of power every year and distributes it to 13 million people through its Florida Power & Light (FP&L) company in Florida. At a recent stock price of $54, it has a market capitalization of $110 billion. That puts it squarely in the “boring, mega-cap utility” sector of an investor’s portfolio allocation bucket.

Yet there’s an interesting catalyst that’s powering future growth. NextEra has committed to expanding its renewable presence, aggressively building wind farms, solar plants, and battery storage facilities. In 2021, it closed down its last remaining coal power plant in Florida and also installed the world’s largest solar-powered battery storage system. Overall, around 60% of NextEra’s total energy capacity now comes from renewable sources (including nuclear).

America is also a fan of NextEra’s renewable power ambitions. Its recent Inflation Reduction Act has extended the production tax credit, which offsets the capital cost of renewable projects. NextEra has generously shared these credits with its customers through reduced rates and refunds, making Florida one of the cleanest and lowest-cost powered states in the country.

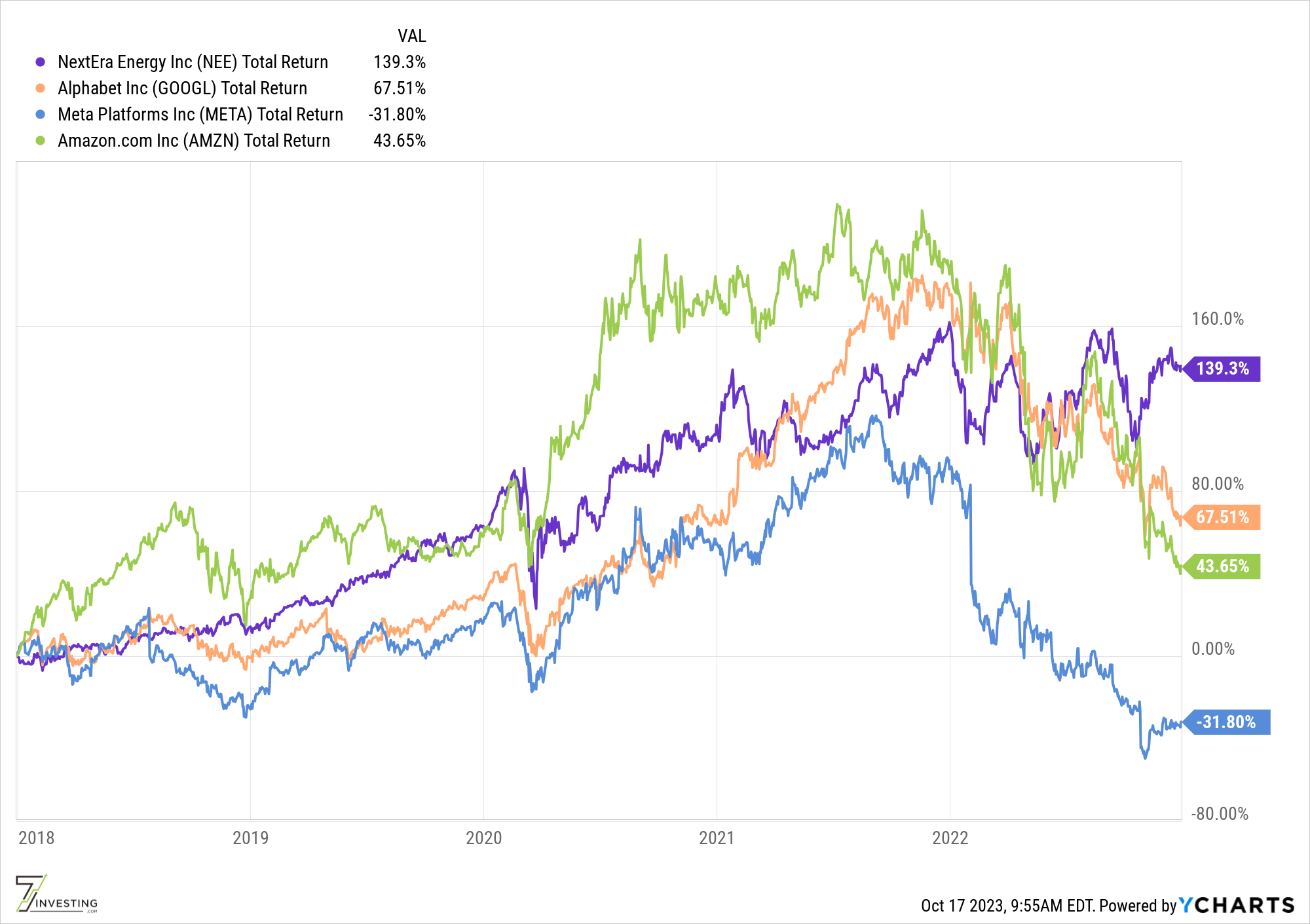

The combination of increasing customer demand, low interest rates, and federal tax credits have been incredible for business. NextEra has nearly tripled its total power capacity in the past five years — from 21 GW in 2018 to 58 GW today. During those five years — from January 1, 2018 to January 1, 2023 — NextEra’s stock generated a 139% total return for its investors (including dividends). This sleepy utility was outperforming many of Silicon Valley’s high-flying tech companies — including Alphabet (Nasdaq: GOOGL), Meta Platforms (Nasdaq: META), and Amazon (Nasdaq: AMZN).

As long as NextEra could build new projects that generated a tax-adjusted return that was higher than its cost of capital, it could continue to provide incremental returns for its equity shareholders.

But things have changed quite significantly this year.

Interest rates are rising, which makes the capital cost of new projects more expensive. This particularly an issue for NextEra’s subsidiary NextEra Energy Partners (NYSE: NEP), who finances and then owns several of the projects and has much of its previous debt rapidly approaching maturity. That means it will either need to pay it back at face-value or refinance at much higher interest rates.

That led NextEra Energy Partners to announce that it would be reducing the annual growth rate of its dividend from more than 12% pear year to only 6% per year, for the foreseeable future. That means there will be fewer distributions bubbling up to the parent organization, who will now have less earnings available to pay for its own dividend.

Management further acknowledged that in the slower-growth environment, it would not raise any equity capital until at least 2027. In other words, it doesn’t believe new projects would generate a high enough return to clear its equity cost of capital (typically around 9-10%).

The market didn’t like any of this news. Shares of NextEra Energy (NEE) are down (33%) YTD in 2023, while its subsidiary NextEra Energy Partners (NEP) is down twice as much at (67%).

Now selling at just 13 times its trailing earnings, NextEra’s stock is the cheapest it’s been since 2018.

The bad news is more than priced in. Investors who were paying a premium for the red-hot growth during the past five years suddenly seem uninterested in owning this utility any more.

Objectively, if we accept management’s guidance, NextEra seems more than capable of achieving 6-7% earnings growth for several more years. If you throw in a 3.3% annual dividend, investors can count on a pretty safe 10% return per year. That’s not as sexy as the returns of the recent past, but it still outperforms parking your money in a savings account.

Furthermore, additional gains could come from NEE regaining its renewable energy sparkle. Investors who do opt for savings accounts or bonds might be intrigued by NextEra generally increasing its dividend by around 10% every year. Those increasing payouts count attractive institutional capital and boost the stock’s valuation multiple back to its traditional norm.

I believe NextEra’s investors can count on a fairly safe 12-15% annual return for the next five years, which represents a combination of the fundamental growth, the dividend, and the multiple expansion. The company is wisely spending frugally while interest rates are high. Yet as I saw firsthand this month at MIT, there’s no shortage of long-term funding for American renewable energy projects.

NextEra will continue to be a beneficiary of the direction our energy industry is heading. It is a great stock for risk-averse, income-hungry investors to consider.

This 7investing article is supported by our affiliate partner Koyfin. Koyfin’s financial dashboards are empowering individual investors to make better-informed decisions.

Through our partner program with Koyfin, they have prepared a special pricing offer exclusively for 7investing’s audience. Click on the Koyfin image below to learn more about this offer:

Already a 7investing member? Log in here.