The facilitator of housing transactions has been taking on the risk of mortgage loans. That could be a mistake.

October 28, 2022

Redfin (Nasdaq: RDFN) just celebrated its 20th birthday.

Custom image created by DALL-E artificial intelligence

Founded in October 2002 in Seattle, Redfin has become a technology leader in facilitating housing transactions. Its popular app attracts 40 million monthly visitors and its fixed-salary agents help homeowners sell their properties as quickly as possible. Redfin also charges much lower rates (often as low as 1%), which has saved home sellers more than $1 billion in commission payments since its inception.

Redfin’s grown up quite a bit during the past two decades and has unlocked several new business segments during its teenage years. One of those has been Redfin Mortgage, where the company can offer prospective buyers a mortgage loan to actually purchase their home.

The move made sense. If Redfin was going to find homebuyers to purchase those available houses, why not offer them a mortgage loan as well?

It could always sell those loans off to others later on. By playing the role of lender at the point of the transaction, it allowed for less friction from fewer players and a smoother overall buying/selling process.

However, there’s a risk that accompanies Redfin’s entry into the lending market, which is that those loans don’t always work out as expected. If the loans — or the financial market as a whole — take a turn for the worse, Redfin could be stuck holding the bag.

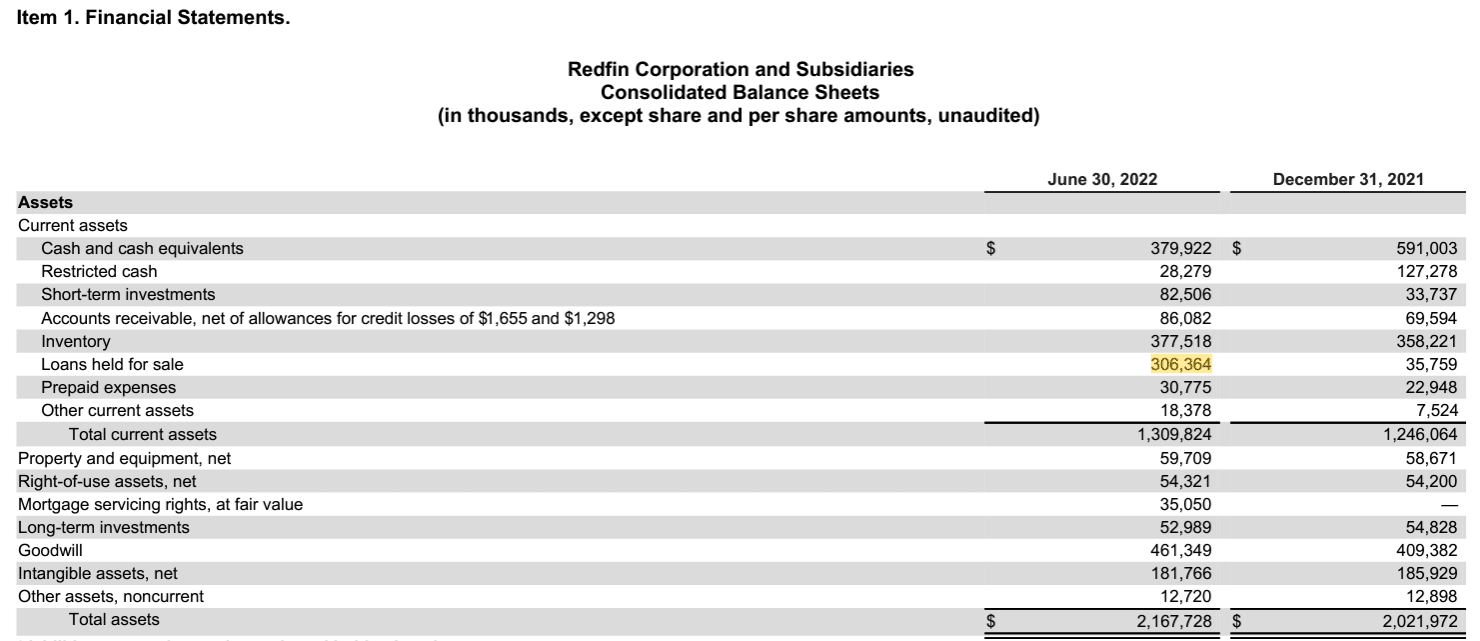

That appears to be exactly what’s happening today. Eager to capitalize on the frenzy of home sales during 2021 and early 2022, the company overextended its Redfin Mortgage efforts. Now, as interest rates are rising and the housing market is cooling off, its “loans held for sale” are becoming a massive liability on its own balance sheet.

Source: Redfin quarterly report

This appears to be a pretty negative development. As shareholders, we want Redfin to be an asset-light technology partner who improves the efficiency of the homebuying process. We don’t want it to be a bank with a bloated balance sheet. Yet its ‘loans held for sale’ balance has increased eight-fold during just the past six months and now accounts for 15% of total assets.

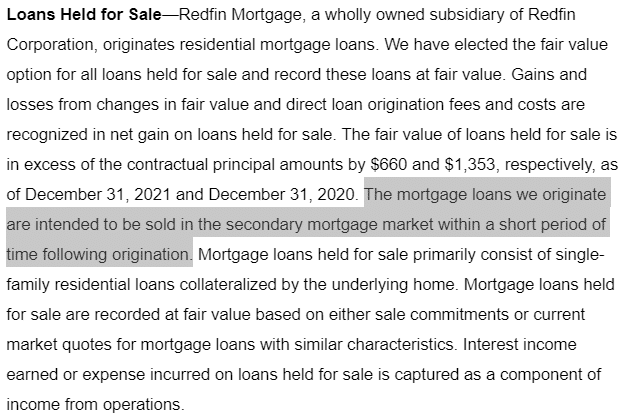

Redfin explicitly states in its annual report that is has the intention of selling these mortgage loans off to others. It doesn’t want to be a bank, and would prefer instead to quickly spin them off in the secondary market.

Source: Redfin annual report

Interest rates are rising quickly as the Fed doubles-down on its hawkish stance. Lenders likely won’t be excited about buying existing loans that are paying 3% interest when they could easily make their own new loans that are paying 7% instead.

Redfin capitalized on the hot housing market by making the mortgage loans seamless. But now it’s the victim of its own success, and finds itself in hot water as the macro becomes more challenging.

This doesn’t necessarily mean everything is doomed. The market has already punished Redfin for its struggles as its stock has sold off 90% during 2022.

Mea culpa.

While hindsight is 20/20 and while Redfin Mortgage likely overextended itself, there is still a lot to like in this company.

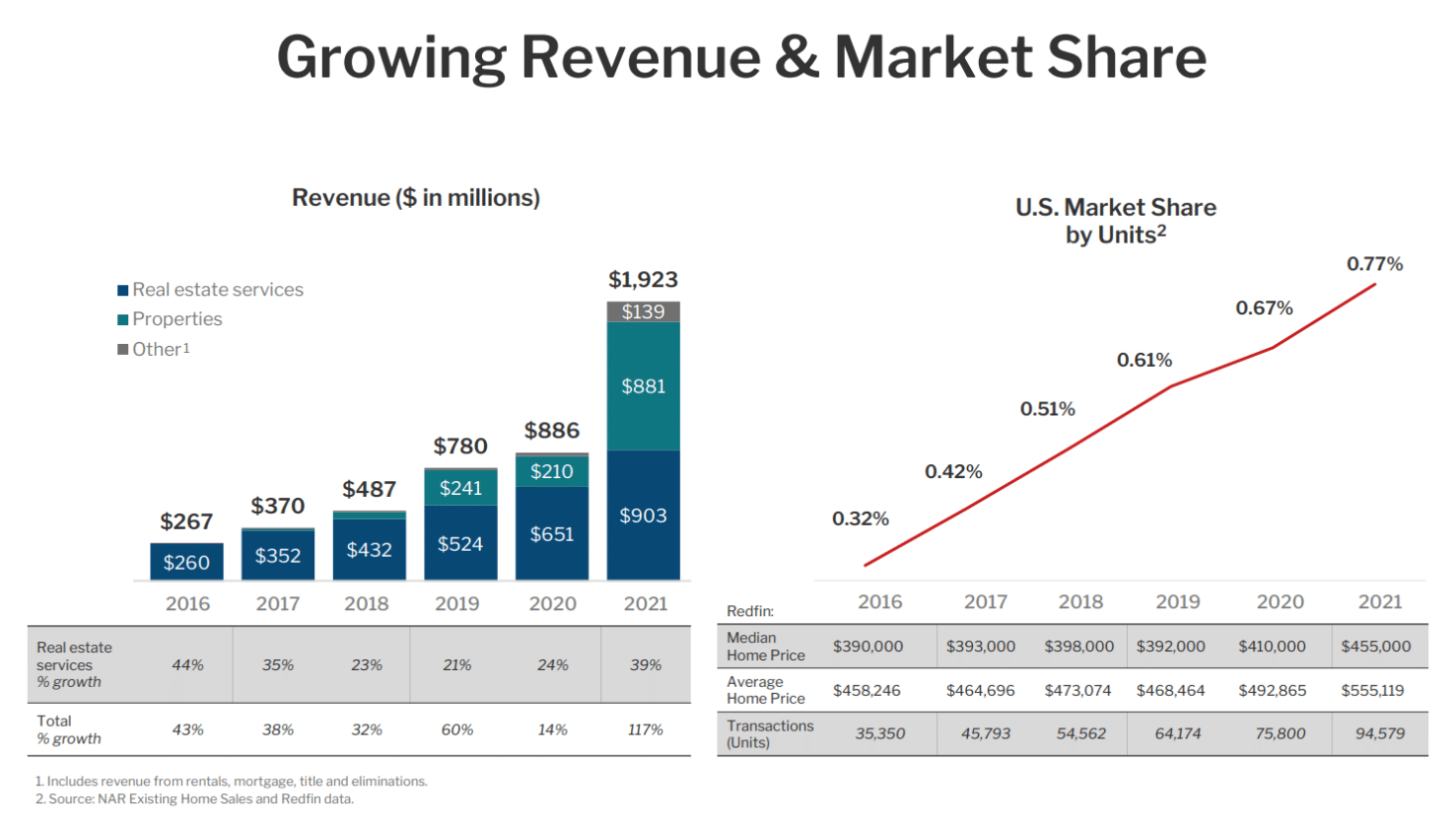

The strongest bull case still remains intact: Redfin is growing its market share and is growing its transactions. Both continue to march steadily higher in annual comparisons.

Source: Redfin Investor Presentation

Redfin still has half a billion in cash and short-term investments, which suggests its balance sheet is strong enough to ride out this storm and still maintain its best-in-class reputation. That could mean existing customers work with them again in the future, and the company continues to serve as the platform-of-choice in our multi-trillion-dollar housing market.

To see our updated conviction rating for Redfin simply click the link below.

Already a 7investing member? Log in here.