Long-Term Investing Ideas in a Volatile Market

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

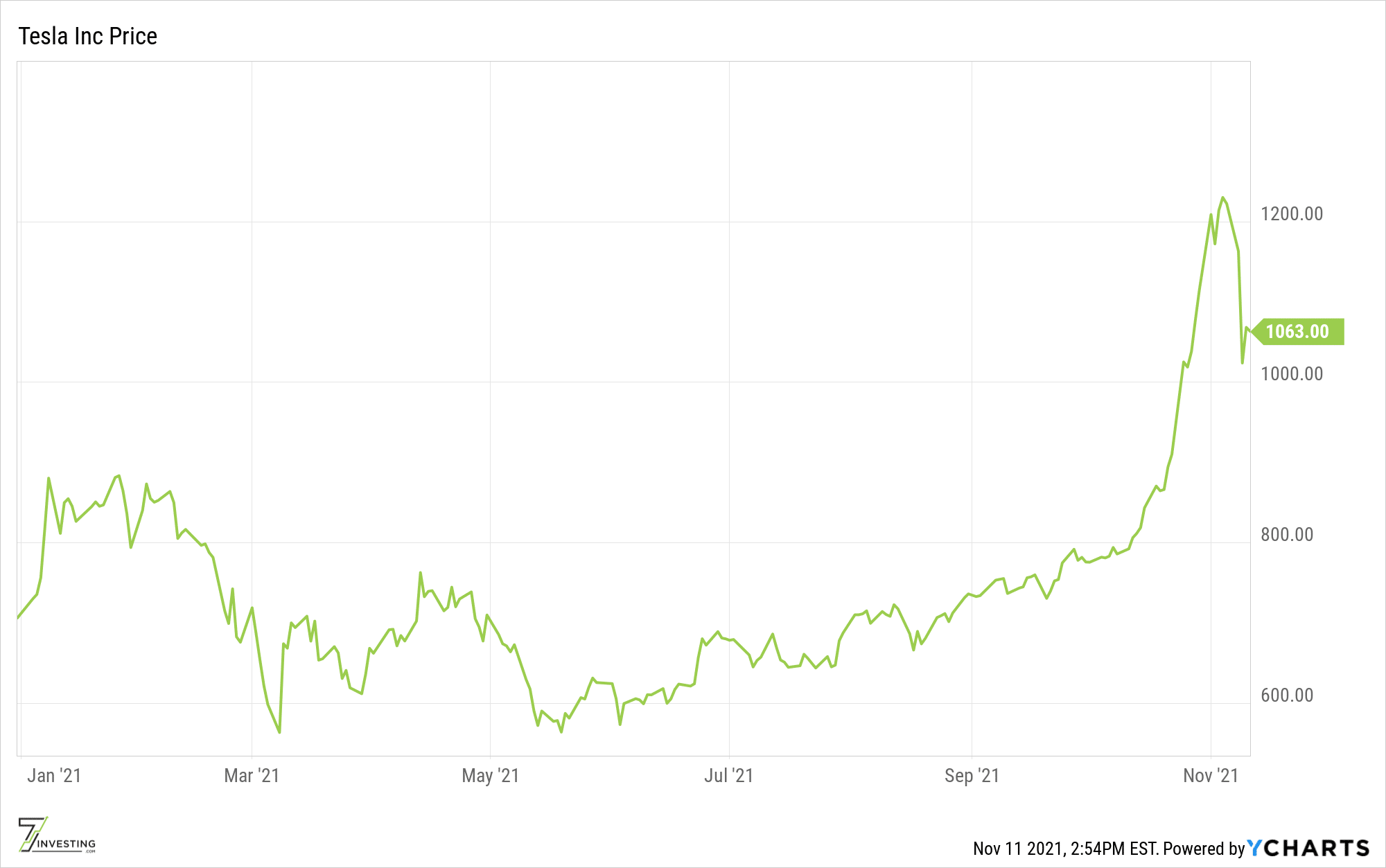

Tesla's volatile stock price has been one of the most popular stories of 2021. See what Chartered Market Technician Irusha Peiris has to say about the stock, and also how institutional investors use technical analysis to their advantage.

November 11, 2021 – By Simon Erickson

As individual investors, there are several things we tend to focus our time on. We’re familiar with identifying competitive advantages. We know how to recognize visionary leadership. And we’re getting pretty good at doing fundamental analysis based upon a company’s sales, earnings, or cash flows.

But there’s another aspect to investing that we don’t discuss quite as often, and that is technical analysis. The stock market is a giant online auction, and the buying and selling is done by human beings. There are behavioral patterns that people tend to follow, and the institutional funds they work for have tens of billions of dollars at their discretion. Understanding how these larger institutions think about investing can be a huge advantage to us as individuals.

So how exactly do those institutional firms operate? Do they think differently than retail investors, or look for specific things when buying a stock? And speaking of technical analysis…what the heck is going on this year with Tesla?!

To help us answer those questions, we’ve brought in a technical analysis expert. Irusha Peiris is a Chartered Market Technician and a portfolio manager at O’Neil Global Advisors. He’s spent his professional career in the investing industry, covering the buy-side, sell-side, and directly representing retail investors. As a portfolio manager at O’Neil, he helps institutional clients determine when is the right time to buy or sell a position.

In this exclusive interview, Irusha spoke with 7investing CEO Simon Erickson about how institutional investors use technical analysis to help inform their portfolio decisions. Irusha reveals specific metrics that institutions look to identify — such as patterns of accumulation or relative strength index — and the frameworks they tend to look for.

Irusha and Simon also refer to Tesla (Nasdaq: TSLA) throughout the conversation. Tesla’s stock price has been a rollercoaster this year, hitting lows of less than $600 and highs of more than $1,200. Irusha describes what makes Tesla so appealing to institutions, as well as what he thinks about its current stock price and valuation. He also shares three other companies that he believes are “perfect waves” of opportunity for investors today.

Publicly-traded companies mentioned in this interview include Apple, Coinbase, Tesla, and Unity Software. 7investing’s advisors or its guests may have positions in the companies mentioned.

Simon Erickson 00:00

Hello, everyone and welcome to today’s edition of our 7Investing Podcast. I’m 7Investing founder and CEO Simon Erickson. I’m excited today to get a little bit outside of my comfort zone and talk about institutional analysis. And some things we typically haven’t talked a lot about at 7Investing, including relative strength and technical analysis. And what is it that’s on institutional investor radars. To talk more about these subjects, I’m really excited to welcome my friend Irusha Peiris to the show. Irusha is a portfolio manager at Omeo Global Advisors joining me from Los Angeles today. Hey, Irusha, it’s so good to have you back on the podcast again.

Irusha Peiris 00:37

Hey, Simon, it’s great to be here. You know, I’m a big fan of you for a number of years. And thanks for inviting,

Simon Erickson 00:45

Absolutely, and I’m sure for your Raiders out there, even though they’ve moved out to LA and now they’re in or out of San Francisco. Now they’re in Las Vegas.

Irusha Peiris 00:51

Well, they were also in LA too, but Las Vegas is not that far away. So there are plenty of LA fans who like going well, just to very quickly digress, I just found out that the Chargers are building their facility like two blocks away from me. And so I don’t know, they’re not going to get a warm welcome here that’s for sure.

Simon Erickson 01:11

Wishing you the best, my friend. We have a lot to chat about today, we’re gonna talk a lot about about a bunch of things. We’re gonna talk about how institutional investors look at investing. We’re gonna talk about valuations. And we’re gonna talk about some sectors on your radar. But I’ve got to start with kind of a big topic that’s hitting the headlines right now, which is Tesla (NASDAQ: TSLA). And you know, we always talked a lot about fundamental analysis with Tesla, we talked about earnings, we talked about sales, but it’s almost expensive on any metric that you look at. And yet still, Tesla stock price continues to go up. Irusha I know that you are a CMT, you know a lot about technical analysis. And I really want to kind of just get your feel for what you think about is what’s going on with Tesla and Tesla stock price right now?

Irusha Peiris 01:54

Well, it’s, it’s pretty simple that Tesla has become the must own stock. Not just with institutional I think with just everyone, but it has just become the stock. Now has a run up a lot. Yes. Could it take a break? And come back in a lot? Yes, I do own Tesla. And so I should say, anything I say, shouldn’t be definitely taken as a buy or sell recommendation here. But that That being said, it’s taken a while. But it Tesla in many ways and I can talk about our kind of the framework that we use to analyze stocks to But Tesla fits that framework. And it’s and really has really fit the framework for a number of years, in that we’re looking for what companies could change the world. And really, there aren’t many other companies out there that can change the world as much as Tesla. And because they have that huge goal that Elon Musk put out years ago that he really wanted to try to help with climate change and try to get off of oil and get into electric cars and things like that. But it’s not just the car, right? They’ve they, through the lifecycle of the company over the last 10 plus years, they’ve come up with so many other innovations out there that it almost seems like it’s converging at the same time, like all of these innovations they’ve done, and different verticals are all just starting to expand. And so it’s become this must own stock, it’s become a stock that’s essentially become impossible to value. And it is obviously with the way it is moving now. It’s clearly in demand and continues to be in demand.

Simon Erickson 03:44

Let’s talk a little bit more about that framework, because it’s definitely got the vision there. Nobody is going to say that Elon Musk is not a visionary leader. But there’s a lot of visionary leaders out there. Seems like Tesla executes very, very well, whether that’s number of vehicles delivered number of orders, they’ve got just the progress they’ve got with me, there’s bunch of things we can say about this. But we know that that’s all out there. Can you talk a little bit more about the framework that you tend to look for and why you would consider Tesla to be a must have stock out there?

Irusha Peiris 04:10

Yeah, so the framework was designed by William O’Neil. So William he’s the founder of investors business daily, founder of originally the founder of the William O’Neil and Company, which was the institutional brand. And that was the first company started 50 plus years ago. And then when he did really well in the markets during the ’82 bull market that really turned out to be like the next great supercycle, but that ’82 run. He made enough money that he started Investor’s Business Daily with that money and to help kind of normal people. So first, he was helping the institutions with kind of here’s a framework how to look at growth stocks or change the world because it’s very hard using kind of traditional valuation type of frameworks to capture some of these new potential monster stocks. And then you’ve learned all that stuff and shared it with us normal people. And I was one of those customers. So it that that that’s really kind of kind of the things of it for people want to learn it. But how to make money in stocks was was the book I mean, I actually have the fourth edition here I’ll show it right here but winning stocks for those 10% who are watching the video, but it’s by William J. O’Neil how to make money in stocks. But just very quickly, I’ll tell you how I got into all of this just the stock market. I was a bio major I had no I had no idea about stocks, even after college, doing medical research thing about becoming a doctor. But you know, like everyone else, just like oh, man, I should put some money in the stock market. Well, I started putting the money in the stock market around ’98 or ’99. And obviously, we know that that was the whole.com boom, and all my stocks went up. And I thought I was a genius. But it was really 2000 When everything came down and all my stocks came down too that I started to realize that wait a minute, there’s more to this. And so I learned immediately that it was the buy and hold wasn’t necessarily for me. And what appealed to the strategy that Bill O’Neil was talking about is he’s talking about a framework first looking for growth stocks, and I, I love technology and all that kind of stuff. So that appealed to me. But also risk management, you got to have some kind of exit strategy when you know you’re wrong. And that I never heard anyone talk about the stock market before it was like you know, stocks going down, you buy more, you know, and there are a lot of stocks you’ll get away with if you’re picking good. But there could be some that you keep buying down just keeps going down. And I where it could destroy your portfolio too. So that kind of strategy of having an exit strategy appealed to me. Now the framework really appealed because I never heard about someone talk about look for newer companies that are changing the world or bringing in technology that it’s hard for people to imagine. So really some of the things that he looks for in the framework and really what we teach daily what we also go over on the institutional side at William O’Neil and Company we’re looking for, okay, companies that are having these these huge earnings and sales. So on a quarterly quarter to quarter basis or a year over year, but just on quarterly perspective, there are some companies are going to have triple digits, you know, their their EPS are 100% higher than they were the year before. Their sales are like 70 80%. And it’s pretty consistent. You’re just seeing these monster numbers come after over a year, quarter over quarter, and then eventually over three to five years, they’re pretty consistent at these putting these monster numbers. Those are numbers that very few companies can do. Right. And so they must be doing something special. Either they I mean they have a product that’s out there that’s so in demand or service and they’re just selling out and and a lot of times what’s happening there, right? They’re creating a new, they’re creating a new market, a new category. And everyone’s thinking, oh my God is the greatest thing. Apple (NASDAQ: AAPL) 15 plus years ago is a perfect example. They came up with the iPod. I remember when I saw that thing. I was like who would be dumb enough to buy a $400 music player when I got my Archos jukebox music player for 100 bucks, right? But what I didn’t realize is that they’re making it easier to upload music and maintain it especially once a move to the PC. And then of course they took that money so Apple at that time triple digit earnings triple digit sales just going great margins are through the roof. They obviously took that and turn in the iPhone, the iPad and all these other things. But same thing with the Tesla, right so now they’re starting to put all these huge earnings in sales. And where Tesla really initially came up on the radar for me was back in 2013. Sometimes you’ll discover you’re not even by seeing the the the numbers. I saw the car. I still remember I was in Santa Monica on the Promenade. And they had a showing there and I saw the Model S for the first time. And it was a $90,000 electric car. And I was like this is the most amazing car ever seen in my life. And they were selling out of a $90,000 car. And so I started thinking if this guy pulls it off, he could change the world by convincing people buy a $90,000 electric car right? So that was kind of the first place where it really started to kind of you know, trigger in my head that this could be one of those game changing stocks. Now it took a little while for them to get their earnings and sales but we’re looking for huge earnings sales. And it’s stuff you guys are looking at too, right? It’s not rocket science here. But we’re looking for those huge earnings and sales. Margins. Growing category, game changing product. And obviously a visionary leader really helps too. But the other kind of part that we look at that probably differs from a lot of other growth investors is we’re also looking for price performance we’re looking for, is this stock dramatically outperforming the market? Is it, it’s just getting a lot of demand in the actual stock market? Are you actually right when you buy it? Are you actually making money? And it’s not just going flat or going down at that point. So we’re essentially combining the fundamentals on a from a growth perspective, from huge earnings and sales, but also the technicals. So I really, I remember 20 plus years ago, when I was learning about technical analysis and fundamental analysis, everyone was kind of just all or none, you know, and out, you know, it’s like, why take the best of everything, you know, and kind of combine it, which is what Bill did with his strategy. And, and so it, it really helps me at least, narrow down the list of stocks to focus on first more fundamental perspective. And then from a technical perspective, is it actually working? Is it moving? Stocks that are in demand behave a certain way, there is a characteristic to them, they just keep crawling up. After an earnings report, they make jump on huge earnings and things like that. Those are institutions that are falling over themselves to get more of those shares. And so they just they seem to not want to go down. Likewise, when stocks are starting to act unhealthy, they behave, they behave a certain way, too. So there is that behavior, there is that kind of normal abnormal action that we look for, that helps us gauge whether the stock is truly in demand.

Simon Erickson 11:50

Irusha I’m gonna move on in a second here. But I’ve got to ask you before we finish this segment up, Tesla’s at just under $1,200 a share right now, are you buying? Are you buying shares at Tesla right now? Or is this going sideways? Or down from here? What What’s your shot? what’s your what’s your take on Tesla shares right now?

Irusha Peiris 12:06

Well, right now, we think Tesla’s too extended, right? Tesla was around and this for me personally, what I thought, you know, around like the 700, 800, that’s where it’s looking appealing. 900, once it crosses 900 and all time highs. So okay, something’s, something’s different here. It’s starting to hit new highs, again, after taking a year off, essentially. You have to respect the market in that because in the end, and one of the big things, especially that I that I learned from Bill is that the markets always right, it you can do all this work. But in the end the markets always right. And so you have to go with the market. So you don’t if you think Tesla’s overvalued or it doesn’t appeal to your strategy, that’s fine. But at the same time, you really shouldn’t go and short Tesla, because the markets are saying that it’s in demand, and it’s going up. And there’s a lot of risk if you’re going to try to short something that’s in true demand at that point. But Simon, what I could do is just to illustrate it, I could just share, share my screen quickly, and we’ll talk through this. But here’s Do you see my screen right here?

Simon Erickson 13:15

Absolutely. Yep. Go ahead. We got ya.

Irusha Peiris 13:17

Okay, so. So here’s Tesla, there’s a market smith chart, I have it on the weekly chart right here. And so the first thing that you can see is just I mean, just just monster run, you know, it’s this is not normal people pushing the stock up, this is not you and I buying our shares at this point. These are larger funds getting into the stock. This is the market cap is over a trillion dollars now. So over on the right hand side here, we have we have a number of quarters of fund ownership. And so in December of 2019, there are 1100, essentially 1200 funds in the stock. Now you go out to September 21, 2900 funds. So there are more and more funds. So this has become in many ways the must own institutional stock, right? So a lot of times really the whole strategy that we look for is we’re trying to figure out what are the institutions looking for? What are they going to be really wanting? Because in the end, 70% of the movements and stocks are because of these larger institutions, it’s the Fidelity’s and and these monster kind of funds with all this money that are buying some of these stocks. Now the reality is, is they’re not gonna be buying when the stock is that they’re not gonna be buying Tesla when the stocks at $1,200 They’re buying it when it was at $600 when when it was kind of basing and going sideways and taking a year off. They’re the ones who were slowly buying the stock after kind of those first few months in the year where it was starting sell off at 600. And you know, people getting out of it and who knows no one knew at that point, what was going to happen but all sudden there’s kind of a floor around 600. And then they’re just more and more funds just slowly scooping up shares of Tesla. Tesla was also pretty attractive, because it’s just, there’s a lot of liquidity in it, you can move in and out of it for these funds, it’s huge, because they don’t have moved, they’re not gonna move the stock that much. But but a huge couple of big things here are first Tesla had this monster run going, you know, obviously, Cathie Wood, very famous with her amazing call on Tesla. But you had this strong, super strong run right here. And Tesla was, along with Zoom the stock of 2020, where it just defied all odds. But there’s so much demand. And in many ways, you know, Tesla was more the institutional kind of darling than, than Zoom, because you’re seeing zoom kind of fall apart right now. But then it spends 2021, taking a break. But the fact that once the last few weeks, once it started getting back above these new highs around past 900, that’s when it was like this, who knows this, this could just this could go on another run, we just don’t know at this point. But that being said, you have to just kind of, if you get your position, you kind of have to let it ride. Now, if you’re up a lot, take a little bit off, you know, that’s never a bad idea to kind of take a little bit off if you’re feeling a little nervous. But that but we don’t know how far this can go. Just like we didn’t know when Tesla started to in 2019 started to really run at that point, we didn’t know how far it was going to go at that point, too. We just knew that it was in demand that there was a there was more of a character change. And I’ll actually switch to a monthly chart right here. You can see this is the 2013 2014 runs. So from 2013 to 2014. Tesla went up from this split adjusted right now but from $6, up to $40 or $50, right had that first monster run with the Model S. It took six seven years for them to really prove to Wall Street again that they’re gonna pull off the model three, they weren’t gonna go bankrupt, all that kind of stuff, all that stuff kind of indecisive, which is why went sideways to try to go for a few times. But once they started proving to Wall Street again, that they went through the model three run and now all sudden their TAM, their addressable market is starting to expand. That’s when he just started committing more and more funds that they have to get into this. And then I think the other kind of final thing you’re just from a larger conceptual level is Tesla has it’s almost a cultish type of stock to you have that fan base much like you have the fan really hardcore fan base of Apple too there is that loyalty there. There’s that product or service that does such a good job, that it creates customers for life. So that’s that’s another kind of interesting thing just to that that I like to keep in mind sometimes. Is it really getting that kind of customer loyalty customer. Just almost fanaticism going on there. You know, kind of like I’m a fanatic of the raiders and you’re a fanatic of the Saints there Simon.

Simon Erickson 18:15

That is true. And that is accurate. I am a Saints fanatic. That’s very true. Irusha. I love having you on on the podcast, because this is eye opening, this is something like you said we don’t spend as much time looking at. Would you mind if I pull the video back off here for you? Hey, okay, yep, perfect.

Irusha Peiris 18:32

Kick me off.

Simon Erickson 18:33

You’re going strong. Irusha, you have worked in the retail investing sector. You’ve worked on the buy side sector, you’ve worked on the sell side, you’ve seen a whole bunch of different things. I want to kind of double click on a couple of things you said in that last segment, mostly kind of the behavioral aspect of institutional investors. It seems like when Tesla is an example of this, you have a company that really shows it’s credible. It has rapidly growing revenues as rapidly growing earnings. It almost feels like institutions that are holding billions of dollars of money. Like you said, Tesla goes from, what was it within within 18 months or something like that three times as many institutions were buying now it’s a must have in funds. It has earned its credibility. It’s earned its keep. And it seems like behaviorally, no one wants to bet against Tesla, you’re gonna burn the shorts, and then Elon is gonna mail you a package of shorts to your doorstep. You know, but I want to ask you on the other side of that, too, can you can you talk about two other things, too. I’d like to know how institutions think about short interest in a stock and then also how you kind of generally institutional investors think about valuation?

Irusha Peiris 19:40

Yeah, it’s kind of hard for me to speak from from the institutional perspective. Yeah. So because, you know, institutions in they’re people like just like us, right, you know, we always kind of think that they’re there. They’re all just going to be pure fundamentals. They’re gonna Hold for the longer story, they probably modeled Tesla out years ago. And somehow they’re always made some Cathie Wood is a perfect example of that. But there are a lot that haven’t in there a lot, who’d still who still doubt it, and they may and there are plenty who are shorting it, too. So everyone has their thesis for the institutional from that perspective. And that’s what makes a market right, there’s going to be all this disagreement, that’s what you’re gonna always have buyers and sellers. But with the institutions, our whole strategy, and so I’ll get back kind of kind of the core concept of why we do things, the way we do them. Our whole strategy is to try to figure out what’s going to be appealing to the institutions. And just mainly the growth funds. So it does not Warren Buffett is not going to be going at Tesla anytime soon. Right? I mean, it took warm a Warren buffett What got into Apple, but five years ago, maybe and made Apple was appealing to us 15 years ago, right. So and I think one way to look at this as we’re looking for those next, great companies that are great growth stocks that are eventually going to turn into great value stocks, right? So Apple, I think there’s an Apple’s a turn around too so that, that that kind of thing. But the reason what the institutions, so with a huge turns huge sales, because how many stocks or companies are doing that, right? Not many, and so that increase the odds that more institutions will focus on those companies. Now, once they start having that demand and start going up kind of like the Tesla, that’s showing us that there are more institutions buying it. But the it’s the institutions aren’t necessarily buying they’re not once again, they’re not buying at the $1,200 level, they’re the ones creating that base. So we’re looking for those rest periods, we call them patterns, we call them bases. The reason why we like those rest periods, those patterns is because they reflect the potential reflects not always the case, but they’re reflecting institutional accumulation. Once the stocks go up, and it doesn’t matter, Apple, one of the greatest companies that we know ever, out there, its stock would go on these monster runs. And then they would take a long time off, it doesn’t matter how great these stocks are, they’re going to take some time off there. And they’re going to come to a point where they get to a price on a valuation basis. Because institutions are obviously going to be much more interested in the valuations than I then I’m personally going to be, but they’re going to, it’s going to come down to a point where it’s going to be appealing to them. And so they’re gonna start buying it, and they’re gonna be some other institutions, they’re gonna start buying it. And they’re gonna stop the stocks from going down. And eventually, the stocks will go sideways, and they’ll start coming up. Now Simon, I’m gonna throw out this phrase to you that maybe some of or a lot of your listeners may or might not know, you might have forgotten, because it’s been a long time, but there used to be this thing called corrections in the market. We haven’t had like corrections in like, a decade, it seems like right?

Simon Erickson 23:04

I thought the phrase you were gonna say was, “Touchdown Texans” that we’ve all forgotten about. It’s been so long.

Irusha Peiris 23:11

The gloves are definitely coming off today. So a lot of times, bull markets, on average, last three and a half years, and then they will correct for nine months. That’s without the Fed coming in and doing all the stuff that they’ve had to do over the years. But these corrections, a lot of times, they would come and prevent present great buying opportunities for a lot of these great growth stocks that got away from institutions come down at more reasonable valuations. So when they were buying and it wasn’t just one fund, but it was a number of funds when they were buying, they would form these patterns. And so the way that it all kind of started out was Bill O’Neil when he was a young stockbroker in the 50s. He went back and studied the previous 50 years 1900’s- 1950s. And, and said, Okay, let me study all the great stocks of that time, the railroads and the radio companies and the airlines and all all this stuff. And then said okay, what did they have in common? So really, the whole framework has these seven traits that these stocks have in common, which I went over a number of them right now. But one of the big things where he noticed that there are a number of these patterns, and there and now with technical analysis, and I you mentioned, I am a CMT. There’s tons of great stuff out there. I keep it very, very simple. I just focus a lot of time on the behavior, that price and volume action, because that’s going to tell me a lot whether it’s stocks in demand or not. It’s going to give me just a little bit more insight on that. But what Bill noticed is that there were a number of patterns that were forming before these stocks on these huge runs. So the way it’s not necessarily predictive, right, because there are plenty of parents that form a quantum. The most famous one that he made most famous is cup and handle, right? So A lot of these stocks have these huge these companies, Apple had a cup and handle in 2004, add a couple of handles and a number of the other bases throughout its monster run. But just because the stock forms a cup and handle does not necessarily mean it’s going to go up three times, it’s going to go up three times because of those great fundamentals. But the reason why I like these patterns, not only because it’ll give me an insight, when I’m looking at a lot of stocks, I can look at charts for us because charts are going to communicate very quickly with our stocks and healthy or not much like a doctor’s looking at your metrics, and I know your cholesterol is too high your blood pressures, do I, it doesn’t necessarily mean you’re gonna die next next year, but you’re heading towards a path where you’re getting a little bit more unhealthy, you might want to slow that down. Same thing with stocks, we can look at these price action saying, okay, the stocks acting healthy or not healthy. And we and we’re using that as to improve our probabilities for success. But with patterns, most importantly, the pattern will help me manage my risk. So it gets back to that initial point, when I wrote in 2000. The markets down just wrote everything down. That’s where it’s like, you know, this is the kind of risky thing I’m trying to do here, let me so that risk management really appealed to the point where in 2008, I didn’t know what was going on with the whole financial crisis. But I saw in the stock behaviors in the charts, plenty of warning signs that told me to stay out of the market. And so that’s what validated the whole strategy for me, because I avoided that whole 2008 meltdown at the I know I do, I was out like maybe months, months before, like almost a year before, and then never only really get back in because it just wasn’t setting up these things. They weren’t going up these stocks. So I just kind of stayed out. And then it was almost surreal that got that bad. But we had none of us, and including the readers of IBD had no idea. We just knew that, you know, it’s just a little bit more treacherous. Right now, there are a little bit more clouds, there’s a little bit more stuff going on on the horizon. Let’s just play it safe. We’re not going to play as much this time. But so with these patterns, though, that helps us get an idea once you put the all the fundamentals ago that hey, you know what, it’s not just me that’s thinking that this company could change the world, or it’s a great company, just it might not even change the world does a great fundamental company. There are a lot of other institutions. In fact, they might not be telling you, but you can see in their action that they’re slowly buying it, because it’s starting to form some of these patterns. And when they emerge kind of like Tesla, when they emerge out of these rest periods, we expect them to do something kind of like what Tesla’s doing. Maybe not as powerful. I don’t think it’s gonna be this powerful immediately, but we expect them to go up from that point. If they don’t, and they start selling off say, Tesla went up past 900 And now all sudden started selling off dramatically past 700. I’d be out I was like, not what I would be telling myself. I love the story, stuff like that. I don’t know what’s up. Maybe it’s me. Maybe it’s Tesla, maybe it’s the market, something’s off. I’m not gonna play as much at this point. I’ll manage my risk.

Simon Erickson 28:04

Irusha, there’s a lot of risks and concerns from people out there about inflation. Right now. We’re seeing the S&P hit new highs, a lot of people timing inflation interest rates right now. Is that on your radar at all? Do you worry about that in any way?

Irusha Peiris 28:16

I worry about it from all just kind of a I mean, I worry about it. It doesn’t really factor in.

Simon Erickson 28:23

Let me rephrase. I apologies. My question. Is this on the radar of institutional investors right now? Are they concerned about inflation and interest rates going up?

Irusha Peiris 28:31

I think that’s definitely in everyone’s mind. Yeah, yeah. I think yeah, the simple answer it is because of, I think everyone’s kind of expecting that next year is going to be a lot tougher, right? If the Fed takes away the punch bowl, and they end if inflation forces their hand to take away the punch bowl? It’s gonna be a lot tougher markets, right? We may have a correction. People might, you know, get a little surprised there that stocks actually go down. Everyone’s been trained that stocks go up and buying the dips all the time, which is fine. It’s great. But I’ll say this one thing Simon. I have no idea what’s going to happen next year. If we ever get those corrections ever again, and if we ever get a bear market, heaven forbid, I do worry about a lot of investors who’ve been trading around for the last 10 years and then doing very well and well done for sure because but there there is, there is a point where you get conditioned so much and if there is an extreme market kind of like and I’m not saying it’s gonna be like 2000 but kind of like 2000. I remember ’99 Everyone thought the market is easy, me included. And then 2000, rode it back down and I lost even more money than I made in the at the top right? At that point, it wiped out a generation of investors. So history could repeat on on that. And and so that I mean that that’s kind of the the bigger thing. But in the end, I think it depends on your strategy, though, you know, if you’re a longer term investor, if you’re spreading out. If you’re spreading out more, yeah, I think you have risk management already built in place. So I think one big thing that that we’ve even talked about, is figuring out your, your trading style, your personality, find a strategy that fits to you, right? Because one thing I’ve learned over the years, especially from all different types, not just institutional investors, but I’ve spoken to many more retail investors over the years in many different types, you just got to figure out something that works for you. What you’re talking about at 7Investing with your team who is excellent talking about all the time, those are time tested values too right? But you just got to figure out, if you’re really going to hold for some of these stocks for the long term, not to have as big a position, right, you know, you got to have spread out a little bit more, I don’t know how many positions to have 15-20 positions, maybe more, that depends on your personality. For us, one big thing that that I didn’t touch on is one way that we really handle this, then reason why Bill O’Neill became a very, very successful investor for 50 plus years, he would concentrate in positions. So he wasn’t having when he bet on like a and well, one of his big one of the huge winners was Syntax back in the 60s, they made the pill. He didn’t have a 5% position or 10% position in that stock when it got going. He eventually, he probably started out with a 15-20% position and eventually built it up to 50, 80, 100% position. Because he really understood the story he used the charts as risk management. And he also had eventually built a profit cushion. So you might have made like 500% on the positions only, but when you have your whole account into it, you can put a lot of points. Now that being said, if there was just still a handful of stocks, that he was able to do that, over the years, maybe 10, 12, or something like that. But the reason why we value risk management so much, is because we’re going to ideally get into positions that are 15% 20% 30%, even sometimes more, we don’t go that much more, I don’t get that much more as much, but maybe 30% position, right? Even a Tesla is great as Tesla’s gonna is it’s going to come down 35% at some point. If I have a 30% position that’s going to really leave a mark on my portfolio, right? So or if I’m wrong, and all sudden Tesla is really going getting in trouble, like they once got in with the model three, you it’s you’re gonna you could have a 30% loss on your portfolio if it gets really bad, right. So that’s one reason why we value charts and risk management so much is because when things are moving in our favor, we’ll definitely push more chips on the line. And so we’re not always going to, we’re not Yeah, so we’re not always going to ride through the ups and downs of the stock, we’re looking for something very, very specific. And very specific behavior, and then we’re there. And if it’s not there, we’re going to kind of back away. One analogy that that I’ll use, and we’ve used this at our seminars and stuff like that, Laird Hamilton, one of the greatest surfers ever, he was on Charlie Rose, you guys can YouTube this on, go go to YouTube and listen to this. But he talks about preparing for the next great wave, the epic wave, the perfect wave, and how every day he prepares, he travels to the places around the globe where the probabilities are. And he’s mentally preparing and waiting and preparing. And he may go months and months before getting one of those, but he’s always kind of preparing. And if those waves aren’t there, he’s not gonna play with them. Right? He’s not gonna serve them. But once they’re there, he has to be ready. And when we heard that there’s like 10 plus years ago, when we saw that, that’s exactly how we’re investing here. We’re looking for kind of the everything to lineup, the stocks to line up with a great fundamentals and game changing potential, the market lineup. And then, you know, finally being there, and we could still be right. And if we buy those stocks, and we think we’re ready to go, and if it doesn’t go We’ll back away at that point. So that’s kind of the way we approach it. And it’s saved us from a lot of these once upon a time corrections that were there. But yeah, I mean, the way the way that people describe Bill O’Neill and the way I look at the way I look at myself now is it’s more a survivor of the markets. And so my first 10 years as opposed to a lot of people start up right now. The first 10 years here have been amazing. Right, these these have been in great trending markets, some of the greatest markets we’ve ever seen. My first 10 years, I had to go through the 2000 bear market 2008, the flash crash. So it’s funny like how those first 10 years gonna have. So I’m, I definitely respect risk maybe too much sometimes? Sometimes I won’t give them as much time versus some others, they’re much more willing to, to let them ride because that’s what you know, the last 10 years, but the markets will always change. I hope they continue like this, though for the record, I think it’d be great. Did I answer your questions, Simon?

Simon Erickson 35:40

Give me one final one that I want to ask Irusha I got one more open ended question for you. And that is that is where are the perfect waves right now? Where are the setups and the patterns you think are really, really attractive, either in companies or even sectors right now? And then also, if you don’t want to answer that side of it, let’s take the other side of it. Where’s the danger zones you would absolutely stay away from right now?

Irusha Peiris 35:59

Yeah, now. Now a lot of things have been running. So it’s kind of hard to say where our perfect setups right now. But I’ll get it from kind of a larger disruptive level and these are for your listeners, and definitely your subscribers. They’re not a surprise, though, the cool thing is, is that we’re all kind of looking at the same framework. And so we’re kind of fishing from the same pond, we’re just going to be in at different times, and things like that. But all the stuff that’s going on in FinTech, right with just the artificial intelligence making, and I do own these shares of like an Upstart (NASDAQ: UPST), right? Where Upstart’s using artificial intelligence to to work with banks to enable more loans to people who weren’t necessarily credit worthy versus a FICO. So, if you want to know, one stock, I probably wouldn’t be necessarily optimistic about or be a little bit more concerned about is FICO, right? It’s Fair Isaac where they might be being disrupted right now. They’ve been around for 30-40 years, they may be being disrupted by some of these newer companies, like an Upstart. But yeah, so you have obviously, that going on. Yeah, the Buy Now pay later. Within Affirm, there’s a lot of disruption going on with the technology in FinTech, just globally, where it’s making, there’s some things we’re very lucky here in the US where things just work seamlessly here. But it’s not necessarily the case abroad. So there’s a lot that’s going on there. So those are some of the things. Obviously, and I’m not huge on this, but I but I have some crypto, obviously that’s a amazing trend. One stock that I do own is Coinbase (NASDAQ: COIN), one parallel, and I’m just jinxing it now because we know it’s just gonna go down to zero but the way cuz I will sometimes look for some kind of parallels is like, Okay, here’s Coinbase they’re putting up some monster earnings, monster sales. Maybe there’s a parallel between Coinbase which is kind of built as a brand name for retail people who want to get into crypto, maybe it’s similar to what Schwab was going through with a discount brokerage back in the mid 90s and stuff like that so so things like that your so you haven’t crypto obviously influence more and more things blockchain is being is being integrated everywhere. But so those are some things. The metaverse I mean, we even had Facebook (NASDAQ: FB) change their name to that but there there are some there’s so many companies they’re obviously like a Roblox (NYSE: RBLX) is an interesting one. I have a little bit of shares of those. One company that I do like is that I find interesting is Unity Software (NYSE: U), which I own. The reason why I like Unity is there are only two players in the market for just for gaming, right for development if you want to if you want to develop software these days, there’s only really two players you go to either Unity Software, or your Unreal Engine, right? And Unity I can’t remember the stat right now but I think it’s like that 70% of the mobile games are using Unity. And now units expanding to other verticals like automotive and some of the scenes from like, The Lion King we’re using like the I think the leaves and trees are using Unity and then obviously AR and VR Unity is natural for that. And then obviously the metaverse right so so those are some of these things. I think one of the big things that I see with you guys also at 7Investing is just a passion, I see the passion of you guys, this stuff is cool. When you look at fun new growth companies and you say, Whoa, look at all these amazing things that they’re doing. It’s really I get excited by that, you know, I get excited about learning about these companies. And then it’s even more fun when you can get profit off of some of these companies too. But those are, those are some of the kind of those trends I’m always looking kind of for those larger, kind of, like, futuristic type of trends, but that you can get something as basic as look, the EVs are growing big, so naturally, the lithium players are big, too. So that’s a sector that’s in demand. That been doing really well and naturally just because that’s going to be that’s going to be a commodity that all the batteries are going to need. So those are a few of them. I’m sure I missed a ton of them, but there are plenty of there plenty of things ripe for disruption, that’s for sure.

Simon Erickson 41:03

Yeah I love the list or Irusha for those who are following along and you mentioned FinTech and AI was one trend he was looking at Upstart to take on that is $UPST. He also mentioned cryptocurrencies and Coinbase Coin’s tickers $COIN. He mentioned the metaverse Unity software’s ticker is $U. Once again Irusha Peiris is Portfolio Manager at O’Neill Global Advisors. Irusha I always have a lot of fun chatting with you. Thanks for being with me on the 7Investing podcast this afternoon.

Irusha Peiris 41:29

Hey, it was great to be on Simon and thanks so much and let’s do it against.

Simon Erickson 41:33

Absolutely And thanks again for everybody for tuning into this edition of our 7Investing podcast. We are here to empower you to invest in your future. We are 7Investing.

7investing Operations 41:41

Tesla (NASDAQ: TSLA) Apple (NASDAQ: AAPL) Facebook (NASDAQ: FB) Unity Software (NYSE: U) Coinbase (NASDAQ: COIN) Upstart (NASDAQ: UPST) Roblox (NYSE: RBLX)

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

Anirban and Matthew were joined by Alex Morris, creator of the TSOH Investment Research Service, to look at seven former market darlings that have taken severe dives from...

On episode 5 of No Limit, Krzysztof won’t let politics stand in the way of a good discussion - among many other topics!