If Tesla executes on its FSD ambitions, the rewards for investors could be massive.

May 21, 2024

In my article last week, I dove head-first into quantifying what Tesla (Nasdaq: TSLA) “the Car Company” was worth.

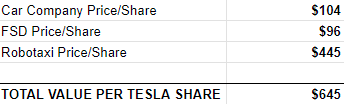

Using a discounted cash flow valuation model, I estimated Tesla’s future vehicle sales through the year 2040. I then deducted all of its capital expenditures and operational costs, to ultimately come up with its free cash flows every year. After discounting those cash flows back to the present, I came up with current value of $104 per share.

That took quite a bit of work to complete. And it also ruffled quite a few feathers.

Some were quick to point out that Tesla’s stock is currently selling for closer to $180 per share; which is nearly 70% higher than my price target. Was I implying that the market is far too optimistic, and that Tesla is right now vastly overvalued?”

No, actually not at all. I purposely described Part 1 as “the Car Company”, to quantify value of Tesla’s auto manufacturing business first and foremost.

And unsurprisingly, it demonstrated that the auto business that we know today isn’t all that attractive.

There’s fierce pricing competition from other automakers. It requires billions of dollars to build manufacturing factories. There are regulators, recalls, and political intervention.

And yet the only revenue stream primarily comes from the upfront sale of the cars (plus a very small contribution from repairs and servicing down the line).

But Elon Musk also knows all of this quite well. He’s a sharp guy, and he wants to make sure that Tesla is much more than just a car company.

This has led Elon to incorporate artificial intelligence into Tesla’s vehicles. With the first opportunity being full self-driving software (FSD).

By arming its cars with FSD capabilities, Tesla can charge drivers a monthly subscription for the use of the software. It used to be that anyone purchasing a Tesla would need to pay $8,000 upfront for the FSD option. But just last month, the company began offering the service for a monthly fee of $99.

FSD has huge implications for investors. It transforms the vehicles into recurring revenue machines, which would now generate an additional $1,200 per year for each FSD that is activated.

So now let’s look at some numbers.

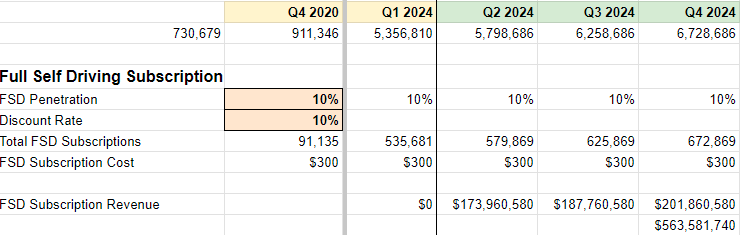

There’s an estimated 5.8 million total Tesla vehicles on the global roads today and I estimate this will increase to 6.7 million by the end of 2024.

Let’s also assume that 10% of those total vehicles activate the FSD subscription. That would mean Tesla would collect $300 per quarter from 580,000 cars today and from 670,000 by the end of the year.

That would result in $563 million of recurring FSD software revenue in 2024.

That might not sound like much right now. After all, $563 million is pocket change when compared to the $80 billion that Tesla will generate this year from selling its vehicles.

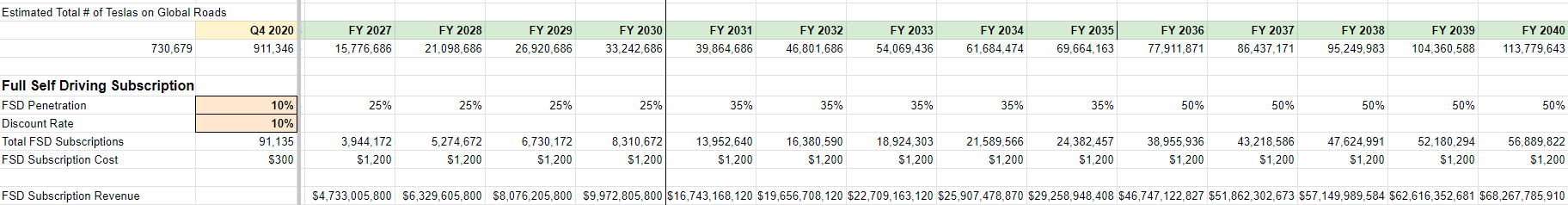

But let’s play this forward. Say that 10% of Tesla’s vehicles enable the FSD upgrade through 2025, but that increases to 25% in 2026, to 35% in 2031, and to 50% in 2036 and beyond.

By 2040, that would result in 57 million autonomous Teslas driving around and generating $68 billion of annual FSD software revenue. $68 billion in high-margin recurring revenue is a pretty darn impressive income stream!

And things don’t even stop there. In additional to selling you a car for you to drive yourself around, Tesla also wants to sell you a car that will make money for you.

Tesla’s Robotaxi Network is essentially a combination of AirBnB and Uber. Similar to how AirBnb allows homeowners to rent their properties to guests, Tesla’s Network will allow those who own its vehicles to provide autonomous transportation to others on a per-ride basis. And similar to Uber, there will be an app to arrange the pickups and to collect the fees for every ride.

This project is still taking shape and the details are far from finalized. But it’s likely the vehicles used for the Robotaxi Network will be very similar to Tesla’s Model 2. The only difference would be that they won’t have a steering wheel (yes, seriously).

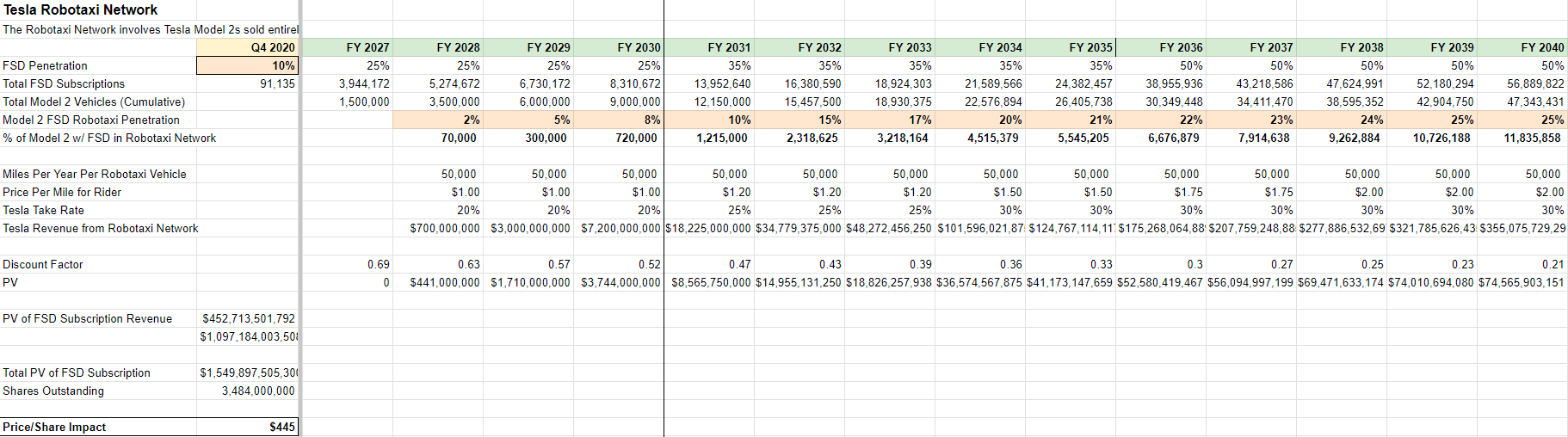

So let’s again play with some numbers.

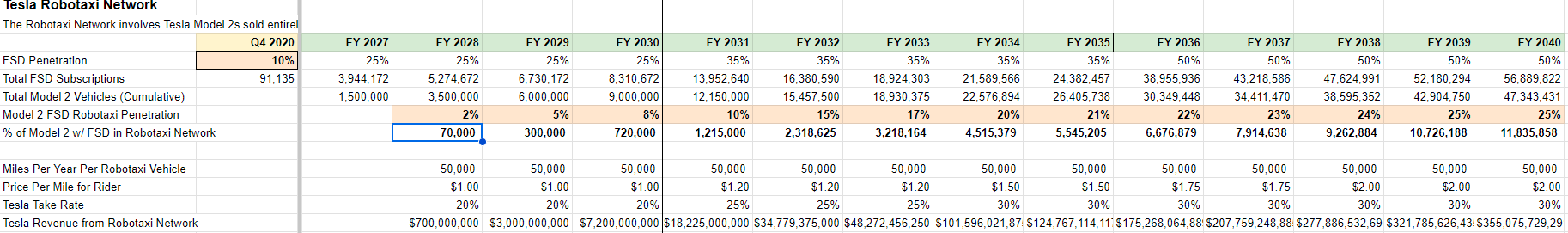

Let’s say that Tesla produces 3.5 million Model 2 vehicles in 2028 (see my last article for the assumptions that went into this) and that 2% of those are autonomous Robotaxis. That equates to 70,000 vehicles.

Let’s also assume the average Robotaxi travels 50,000 miles per year.

And furthermore, the rides cost $1 per mile (around half of Uber’s current rates), and that Tesla takes 20% of that as its fee for running the network.

70,000 vehicles each generating $50,000 in gross bookings and $10,000 in revenue for Tesla per year equates to $700 million in revenue in 2028.

Let’s assume that Robotaxis will represent 10% of the total Model 2 production output by 2031, but that will gradually increase to 25% by 2039. I expect the price per mile will rise alongside inflation, reaching $2 per mile by 2038. And Tesla’s take rate will similarly increase, from 20% in 2028 up to 30% in 2034 and beyond.

The resulting financial impact could be quite significant. 11 million cumulative Robotaxis in 2040 would generate $355 billion in annual revenue.

Does that sound too good to be true?

Perhaps it is. But also consider that last year, Uber reported it hired 5.4 million drivers globally, facilitated 7.64 billion rides, and generated $138 billion in gross bookings.

My assumptions described above would imply that Tesla’s Robotaxi fleet in the year 2035 — more than a decade in the future — would be roughly the same size as Uber’s driver base is today.

That suddenly seems quite doable. Especially when its a fully-autonomous fleet that doesn’t need to pay for drivers.

Now comes the fun part and the punchline. Now we’re finally going to estimate what FSD and Robotaxis could be worth to Tesla’s investors.

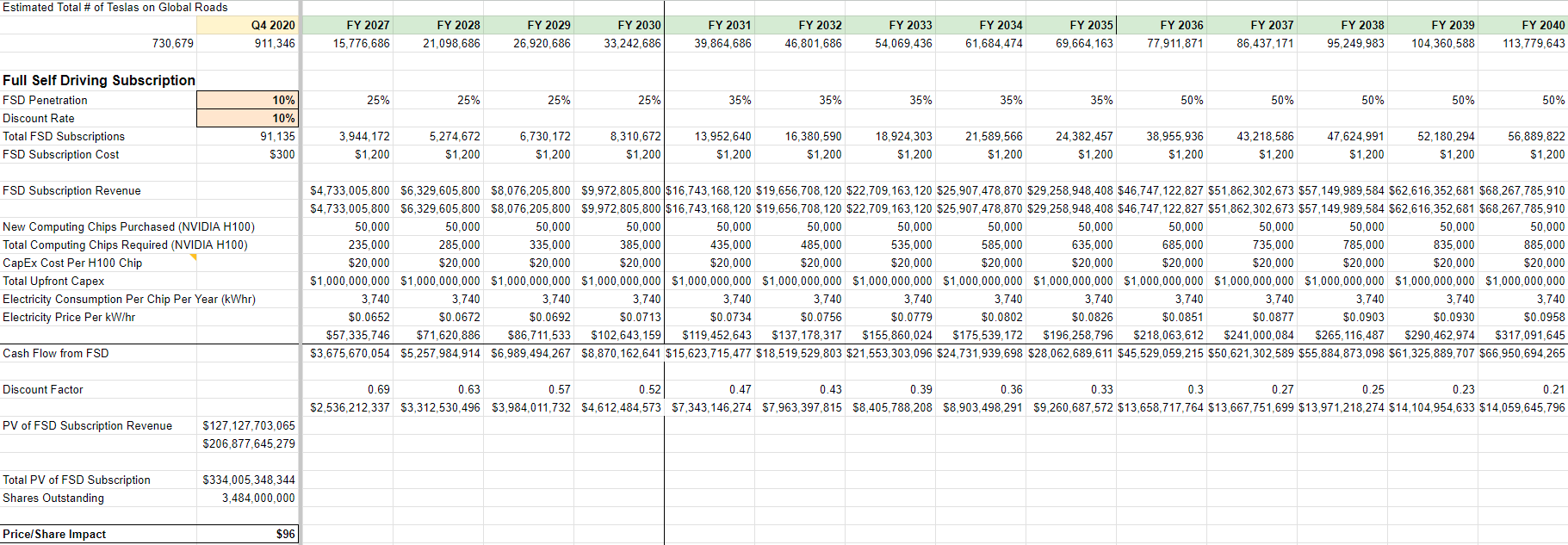

Using the same methodology as I used to value Tesla as a car company, I similarly discount the cash flows from Tesla’s AI ventures back into the present.

Rather than paying for aluminum frames, batteries, and drivetrains, the FSD software and Robotaxi network rely on computing that’s done by processors within Tesla’s datacenters.

That will require them purchasing a vast number of high-performance chips, specifically NVIDIA’s (Nasdaq: NVDA) H100 GPU processors.

Yet even an aggressive assumption of Tesla buying 50,000 H100s annually just to keep up with the computing required to navigate its autonomous fleet would still result in a massively-profitable new business.

I estimate the Full Self Driving subscriptions are worth $96 per share in today’s present value:

And I estimate the Robotaxi Network is worth $445 per share in today’s present value:

Combining the $104 per share estimate for “the Car Company” with the FSD and Robotaxis, Tesla’s AI ambitions could suddenly make its stock worth closer to $645 per share.

Before jumping in head-first and buying Tesla’s shares, realize that these are just spreadsheet estimations. More importantly will be if Elon Musk and Tesla can actually execute on perfecting their autonomous driving models and introduce FSD vehicles to the mass market. If they do, it would completely disrupt the entire transportation industry.

This DCF exercise was meant to serve as a guide for investors. To demonstrate what Tesla’s core business was worth today, and what its future ventures could make it worth tomorrow.

If Elon continues to do what he says he’s going to do, the transportation market is certainly large enough to make Tesla yet another multibagger opportunity for investors.

This article contains institutional-grade research and is only possible to be published for free because of our generous paying subscribers. If you find value in this article, please consider sharing it on social media to help our brand awareness or joining 7investing for just $1 to get similar research reports on all of our official stock recommendations.

Your 7investing membership also includes complete access to our Community Forum, where our advisors and other investors are discussing stocks on a 24/7 basis.

Want to discuss Simon’s assumptions on Tesla directly with him and with other investors?

Simon, Thanks so much for going through in detail your DCF process/analysis of Tesla and other companies recently. Your thoughts and assumptions provide some very valuable insight into analyzing and valuing companies. I can’t wait to see who you work on next, after a well deserved break! Thanks again for continuing to provide value to the 7Investing community – along with the rest of your team who provide some really valuable and honest insight into the companies they follow. Best value for the money as far as I’ve seen for a general stock selection service.

“Simon, excellent work. This discussion reminds me of the INNOVATORS DILEMMA and why it is so hard to frame civil discussion around such a disruptive company. Good job all!””Thanks Simon! Really cool to watch you do this process.”

“Simon, this is fantastic work! I wonder how long do we expect Tesla to benefit from regulatory credits?”

“As I go through all this information, I will have to give 7investing credit, you are extremely transparent and you certainly don’t try to sugar coat your stock picks.”

“Thanks for doing this. So much work goes into these models, that this kind of financial calculus on individual stocks is worth the price of admission by itself.”

“Thanks a lot for working through this publicly, really an excellent exercise.”

“Thanks for the modeling!”

“Thanks for the hard-work, 7innovator! Would be interesting to see if this impacts the conviction rating..”

These are actual posts from actual members in our Community Forum. Click here to join 7investing’s Community Forum today!

Already a 7investing member? Log in here.