Despite some near-term speedbumps, strong global demand for EVs should accelerate Tesla's vehicle sales through 2030.

May 9, 2024

It’s “Tesla Week” here in the Erickson household. In previous years, I might be spending these early days of May recovering from Cinco de Mayo festivities. But this year I’m replacing the margaritas with coffee, and am eagerly going all-in on building a discounted cash flow analysis for Tesla (Nasdaq: TSLA).

Ultimately, I’m doing this exercise to determine a fair value for Tesla’s equity. It estimates all of the company’s future cash flows, to come up with a price that I believe investors should feel good about paying for Tesla’s stock today.

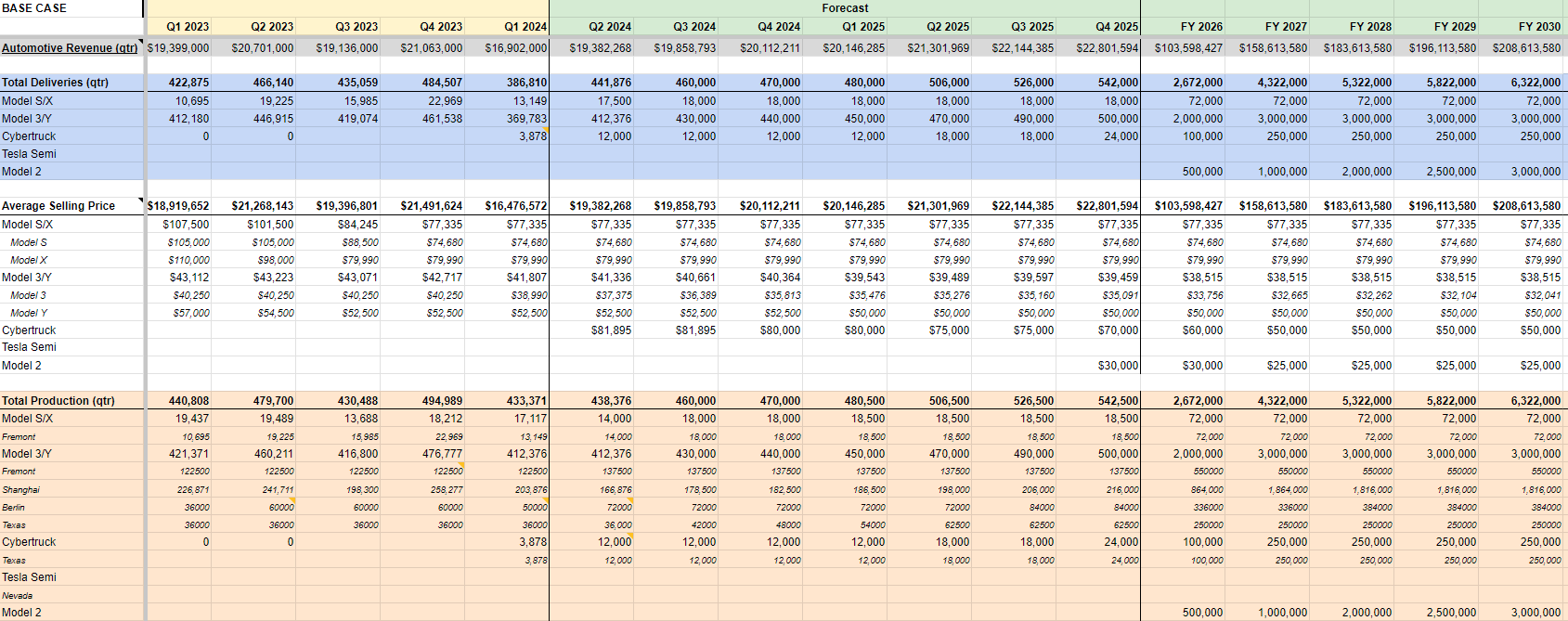

On Tuesday I wrote about my expectations for Tesla’s near-term vehicle sales in 2024 and 2025. I expect these sales will be modest, especially after the company whiffed on its Q1 delivery expectations, changed its Model 3 manufacturing process for cost savings, and responded to intensifying price competition in China.

But I think after cruising past these near-term speedbumps, Tesla’s vehicle sales will accelerate in the later years of this decade.

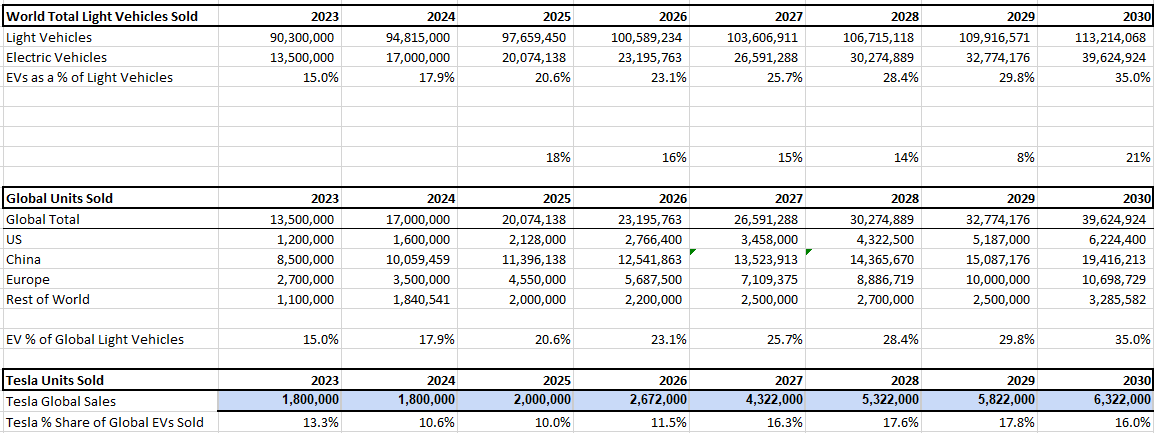

To support that claim, I first looked at the global auto industry by region. The world sold 90 million new light passenger vehicles last year, and that number will likely grow at a similar rate to GDP on a regional basis.

China has heavily subsidized sales through its “New Electric Vehicle” program. While that’s given China a superior growth rate to other countries in recent years, I expect the EV growth rate within developed economies like the US and Europe will actually exceed that of China’s during the next six years. I project the world will sell 40 million EVs in 2030, and those will account for 35% of its 113 million total light vehicle sales.

Tesla will account for 6.3 million of those 40 million EVs sold — giving it nearly 16% global market share in a very fragmented market.

There are a few important factors that will significantly contribute to Tesla selling 6.3 million cars by 2030.

The first is it maintaining its market share of the Model 3 in China. Tesla has doubled its sales in China in two years, from 320,743 vehicles delivered to the country in 2021 to 706,900 in 2023.

But apparently the word got out about EVs being a hot commodity in China. Tesla is now facing fierce price competition from plug-in-hybrid provider BYD and even from typically-a-Smartphone-maker Xiaomi. Tesla has responded by reducing the starting price of its Model 3 in China, as well as offering preferential financing and other upfront rebates.

The second is Tesla will introduce its Cybertruck to the American market. The Cybertruck has already gotten 2 million reservations, as trucking enthusiasts are intrigued by its superior torque and performance.

But Tesla will need to get its price point lower if it wants to convert those to sales. The first Cybertrucks are rolling out of the Texas Gigafactory and are selling for an average price of $81,895 (including all upgrades). That’s still too high for most of those 2 million drivers to actually pay.

The third is Tesla will manufacture its Model 2 at scale by 2026. The Model 2 is Tesla’s “$25,000 mass-market car”. It’s still in prototyping, but Elon says it’ll be ready by 2025.

The price is exactly where it needs to be, to make the Model 2 price-competitive and in the same league as the Honda Accord or the Toyota Camry.

But Tesla wants to far surpass the sales volumes of those competitors. With the support of full self-driving autonomy and the Tesla Robotaxi Network (which will give Tesla ample data to train its neural networks and also to appease the regulators), the Model 2could reach annual sales of 3 million units by the end of the decade.

There are some who might balk at the sheer magnitude of a forecast of 3 million vehicles in a single year. But we should also recall that Tesla has had the world’s best-selling electric vehicle with three three different models: first with the Model S, then with the Model 3, and now with the Model Y.

I believe its vast economies of scale and its superior performance specifications will keep Tesla in the race and able to maintain its global share.

Altogether, I estimate Tesla’s 6.3 million vehicles will generate $208 billion in automotive revenue in 2030. Along with its Leasing, Energy, and Service segments, it will generate $255 billion in total revenue by the end of the decade.

That’s a significant jump from its 1.8 million vehicles sold and its $96 billion in revenue in 2023. But with one of the world’s most visionary leaders at the wheel, Tesla is full-speed ahead when it comes to redefining the auto market.

Already a 7investing member? Log in here.