In its newly-released 60 month plan, Trupanion outlines an aggressive growth strategy. That's great news for shareholders.

May 19, 2021

Trupanion is a leading provider of pet insurance. It’s helping people in North America and Australia relieve the financial stress that’s associated with bringing Fido to the veterinarian.

Its exclusive focus on pet insurance and two decades of operating history makes it one of the best-known brands among vets. And because it pays the vast majority of claims within 5 minutes of checkout, vets have a real incentive to recommend them to their kitty cat-loving clients. There’s no maximum payout for the services rendered (very rare in the pet insurance market), so vets and owners can focus on the pet getting the optimal treatment — without having to stress about the costs.

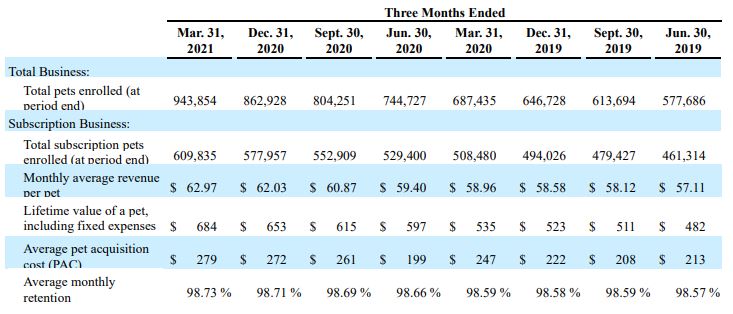

Trupanion also faces a wildly underserved market. While the company already has more than 943,000 enrolled pets, this is still less than 1% of the 200 million domestic cats and dogs in North America.

There’s a lot of meowing and woofing that Trupanion can expand its enrolled pet user base to. And the most intriguing part for investors will be how efficiently it does so, for the good of us as shareholders.

Consider the following:

That delta of $405 — which is the difference between the LTV and PAC — is the “wiggle room” that Trupanion has to market to more expensive channels. As long as its acquisition costs remain below $684 (on an non-discounted basis), it’s still creating incremental value for shareholders.

More aggressive expansion is exactly the strategy described by management in its recent 60 month plan. Trupanion wants to create new distribution channels and leverage its partnerships with other insurers like State Farm and Aflac. It also wants to expand into Europe and Japan, market to owners of newborn puppies and kittens, and even launch a new subscription for a healthy pet food.

This is exactly what investors should want to see. Leadership is showing its claws and is tearing into this vastly untapped market. Revenue grew by 27% and total enrolled pets grew by 37% in the most recent first quarter. Both of these year-over-year growth rates increased over the previous quarter, which suggests there is indeed still plenty of demand for the taking.

Leadership believes it can grow revenue by at least 25% per year for the foreseeable future, reach annual sales of $1.5 billion by the end of fiscal 2025. It also thinks it will more than triple its enrolled user base to 3.5 million pets during the same timeframe.

That methodical expansion is a delightful sound for pets, their owners, and Trupanion’s shareholders.

[su_button url=”https://7investing.com/subscribe/?marketing_id=90127″ target=”blank” style=”flat” background=”#96C832″ color=”#000000″ size=”6″ center=”yes” radius=”0″ icon=”https://7investing.com/wp-content/uploads/2021/04/7Investing-3.png” icon_color=”#000000″]Sign up with 7investing today to get access to our 7 top stock market recommendations every month![/su_button]

Already a 7investing member? Log in here.