This innovative battery maker could be crucial to the future of electric vehicles. But it has to commercialize a product first.

September 6, 2022

Do you enjoy taking risks as an investor? Are you able to shrug off gut-wrenching volatility in exchange for the potential of landing a 10-bagger? Do you like to get in early, especially publicly-traded companies who aren’t yet even reporting any revenue?

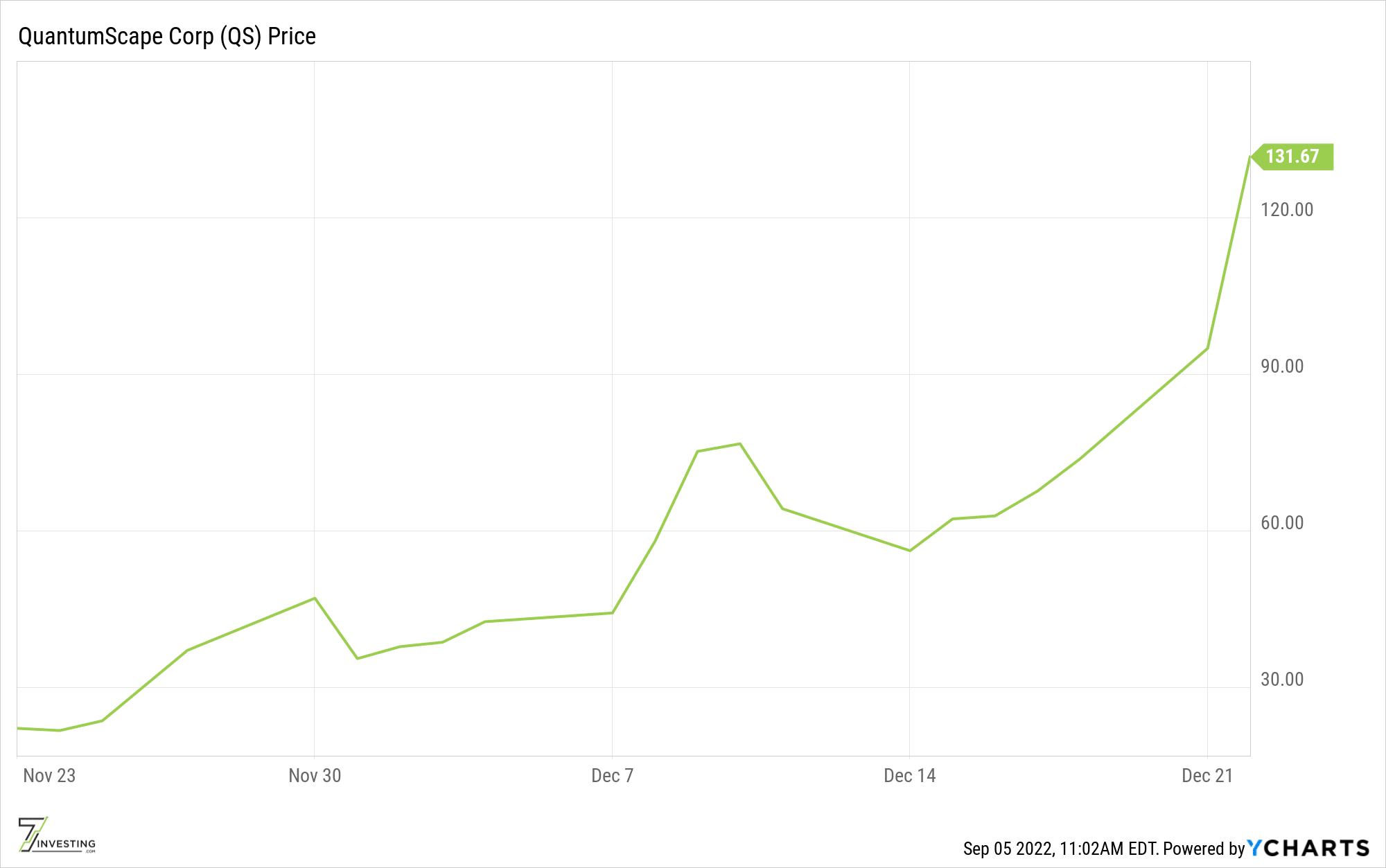

If so, QuantumScape (Nasdaq: QS) might be the stock for you. The intrigue of the solid-state, lithium metal battery maker has captured the attention of investors since its SPAC IPO at $10/share in November 2020. The company took the stock market by storm, rising 120% on its first day of trading and then becoming a 13-bagger within its very first month as a publicly-traded company.

While that ascent to stock market grace was indeed impressive, shares have now given back all of their gains. QuantumScape’s stock today has completely reverted back to the same $10/share price of where it first hit the market in late 2020.

There’s a roller coaster ride of a story within these past two years. QuantumScape is still a pre-revenue business who’s designing solid-state batteries that could find their way into future electric vehicle models. To be clear and upfront, it generates absolutely no sales today, and it doesn’t expect any commercial revenue to hit the books until at least 2026.

Yet the company is also addressing an important market problem that needs to be solved. The vast majority of electric vehicles today, including those sold by Tesla (Nasdaq: TSLA) and others, use lithium-ion batteries as their power source. Lithium-ion chemistry works decently well, but it still has several limitations which might be holding back EV adoption. One of these is its limited energy density, meaning the batteries can only hold so much charge and many would-be consumers are having range anxiety about running out of juice (or finding a nearby supercharging station) before they finish their daily travel routine. Another limitation is the charge time, which can still take an hour or more to fully recharge the battery. And one last key factor are the safety concerns. Lithium ion batteries are notorious for building the formation of dendrites, which causes them to short out and sometimes even catch fire due to degradation within their electrolyte materials.

QuantumScape says it’s time to flip the script of the lithium ion status quote and attempt an entirely new approach. Its lithium metal batteries have significantly higher energy density and also use a solid electrolyte. That means they can travel for a longer range (400 miles+), can charge in less time (reportedly 80% charge in 15 minutes), and don’t have the same safety concerns as their predecessors.

The company still has a long way to go, as it attempts to scale up its prototypes into commercial volumes. It is already working with seven auto OEMs — including its equity partner Volkswagen (OTC: VWAGY) — to develop pilot programs that will lead to higher volumes over time. If it can reliably mass produce its batteries that meet auto OEM specifications in commercial quantities, QuantumScape just might become the most important company of the entire electric vehicle industry.

There’s an entire laundry list of risks inherent with QuantumScape as an investment. First and foremost is that scaling prototypes up to commercial volumes is really hard, and that this pre-revenue company that doesn’t even have a commercial product yet.

But for the purposes of this 7investing article, I’d like to focus on the bull case. I’d like to speculate on what QuantumScape’s potential valuation could be if it were to succeed.

The company has my full attention right now because I honestly believe it would have significant upside if even a handful of its current programs were make it to the finish line by the end of the decade.

Let’s walk through this step by step. And let’s start with quantifying what the electric vehicle market could be worth.

There are several different forecasts that quantify the future adoption of EVs:

Firstly, if QuantumScape does indeed have its solid state battery commercially-available by 2026, let’s assume conservatively that it captures 25% of only the American market by the year 2030. That would mean 1 million batteries sold into EVs by 2030. Check.

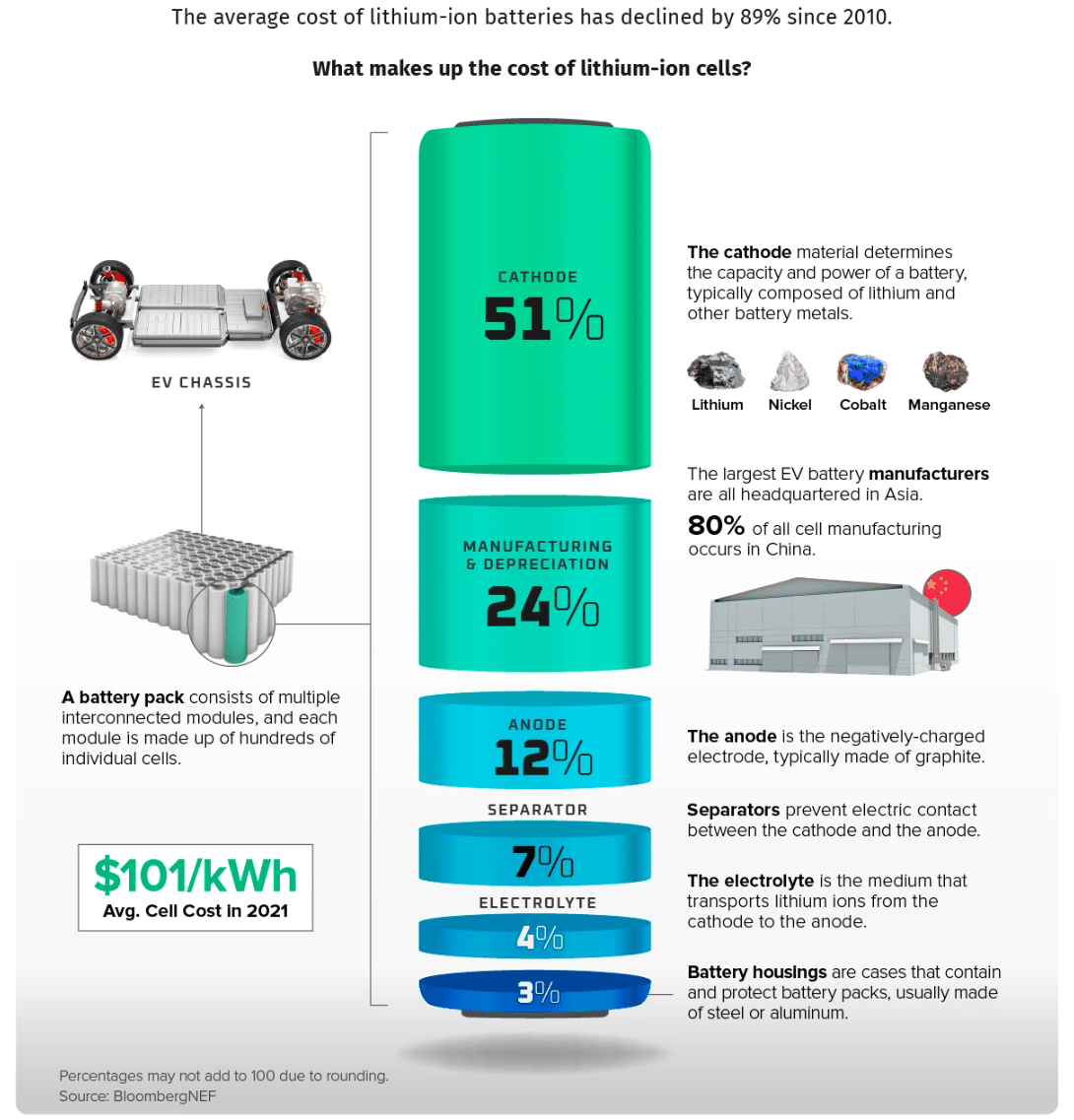

Secondly, let’s think about how much they could realistically price their batteries for. According to VisualCapitalist, the average lithium ion battery cost $101 per kilowatt-hour last year. This was the cost of the battery to the auto OEMs, while the total replacement cost for end users was actually around double this.

Source: Visual Capitalist

Tesla’s Model 3 vehicle has a battery of around 60 kW-hr, though it’s upgradeable to 82 kw-hr. That equates roughly to a battery cost of $6,000 to $8,200 per vehicle, using today’s technology.

So let’s make another conservative assumption, which is that QuantumScape will be able to sell its solid state batteries for at least $10,000 by the year 2030. That’s a 25% premium to the high end of what lithium ion batteries are selling into cars for today.

$10,000 per battery, multiplied by 1 million batteries per year, equates to $10 billion of annual QuantumScape revenue by the year 2030.

And finally, we should assess what multiple the market will award QuantumScape for its efforts. Today, Tesla owns the end-relationship with auto consumers and Tesla’s stock is selling in the public markets at a valuation multiple of 14x sales. Let’s assume that because QuantumScape’s relationship is with the auto OEMs (not the final consumers; like Tesla’s is), that QuantumScape gets a multiple of only half of that. So let’s assume a P/S multiple of 7x for the battery supplier.

A P/S multiple of 7x, multiplied by $10 billion of annual sales, equates to a market capitalization of $70 billion by the year 2030.

It’s perfectly fine to buy a small initial stake in QuantumScape today while the risks are extreme and the valuation is miniscule. We’re only in the year 2022, yet QuantumScape’s market capitalization today is still less than $5 billion. If it were to succeed in developing a commercial-ready battery and achieve even modest success, the stock could have 14-bagger potential.

These are the types of bets I like to place as an investor. There’s no need to back the truck up all at once; we’ll get plenty of updates on the company’s progress during this coming decade. Good news and progress with its progress could warrant adding funds to an existing investment.

Yet the upside is clearly there. QuantumScape has a great leadership team, including the former CEO of Infinera (Nasdaq: INFN) and the former CTO of Tesla. And it has a huge market that is eager to adopt its new batteries.

QuantumScape is quite intriguing and I think it might deserve a place on your watchlist.

Disclosure: Simon Erickson owns shares of Tesla Motors and also of his 7investing Top Stock for September. If you’re a risk tolerant investor, you might also want to see our actual 7investing recommendations for September. Of our team’s seven official picks, five of them are classified as either “small cap” or “micro cap”. We weren’t afraid to go fishing in ponds with risky companies this month, and several of them may also have future multi-bagger potential. To get immediate access to all 7investing recommendations, click here to start your membership today.

Want even more of our coverage on clean energy? 7investing advisor Luke Hallard breaks down the House’s recent Inflation Reduction Act (IRA), especially what it will mean for addressing climate change.

Already a 7investing member? Log in here.