Dividends are among the most-beloved aspects of long-term investing. But why do companies pay them in the first place?

December 9, 2022

When it comes to investing, business performance is only half the battle. In addition to companies figuring out how to make profits, it’s equally important to us that they figure out how to use those profits for the good of us as investors.

This topic of capital allocation is a gargantuan task and hundreds of thousands of full-time employees globally contribute to it. Business analysts are cranking out spreadsheets to prioritize the internal rates of return and net present values that companies could get from allocating to potential capital projects. M&A folk are making risk-versus-reward assessments on buying potential acquisition candidates. Finance departments and CFOs are figuring out the right balance between borrowing or repaying their debt load in order to achieve a good credit rating.

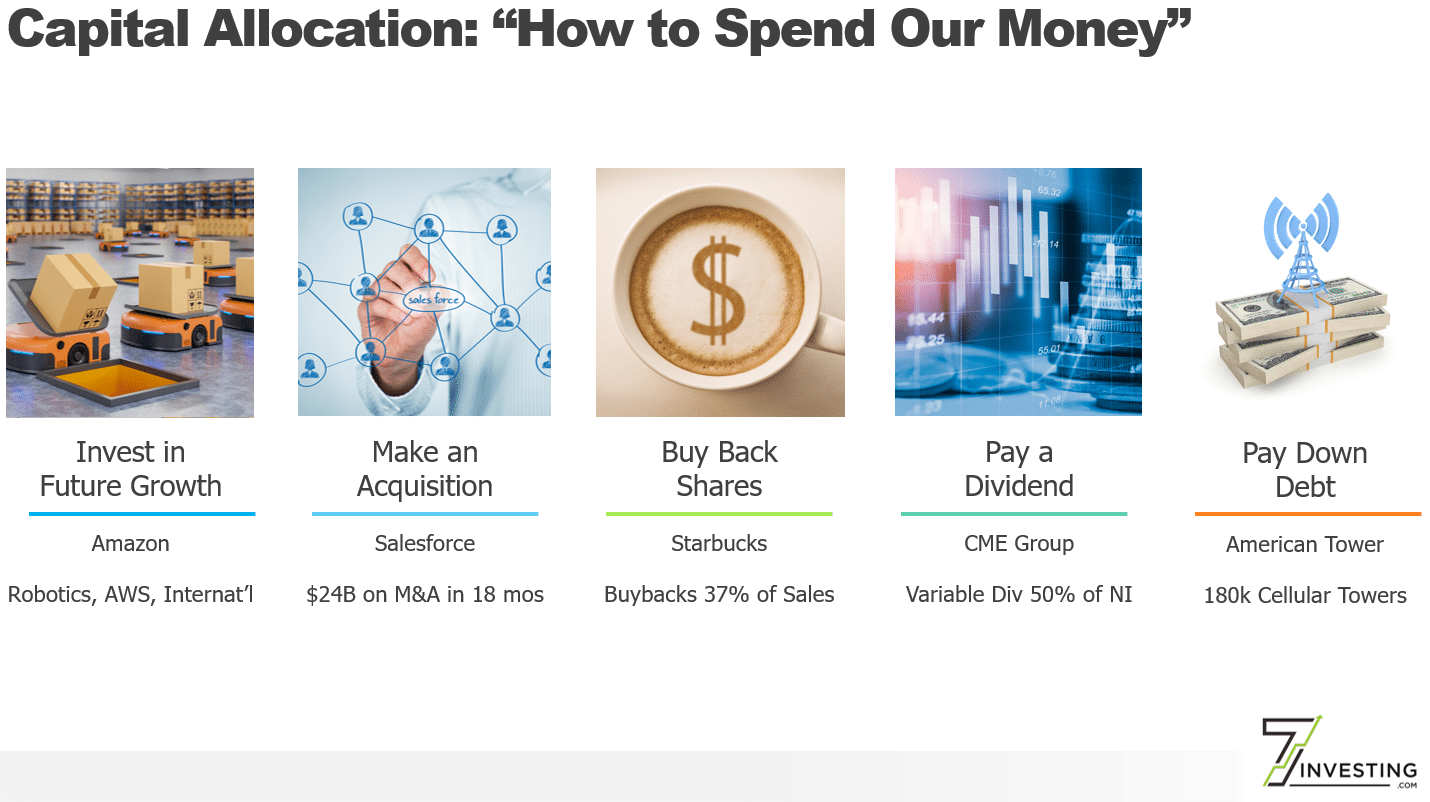

Only then can Boards of Directors make the “How Should We Spend Our Money” decisions. And the choices they make have a direct impact on our investing returns.

Source: 7investing Presentation given to Intel, 2020

One of their options that we tend to love the most as investors is the dividend. There’s nothing better than seeing a company deposit cold, hard cash directly into your brokerage account on a quarterly basis. Dividends can serve as a sense of financial security or a hedge against broader market volatility.

But let’s take a step back and look at things from the corporation’s perspective. Why do companies pay dividends in the first place?

The first and most obvious reason is to appeal to investors. Dividend stability instills confidence, and investors are often willing to pay higher multiples for that stability and prestige.

The Dividend Aristocrats are the royalty of the market’s most generous cash payers. It’s a list of 65 companies who have increased their annual dividend for at least the past 25 years. Well-known companies include 3M (NYSE: MMM), Coca Cola (NYSE: KO), and Johnson & Johnson (NYSE: JNJ), all of whom have increased their dividend during each of the past 57 years. Any of the companies on this list are the ultimate “buy and hold” investments, which attracts longer-term investors and leads to less turnover.

Somewhat related, several institutional funds are required to only select from dividend-paying companies. Massive funds like Vanguard’s Dividend Growth Fund (Nasdaq: VDIGX) invest in companies with stable and growing dividends, such as The TJX Companies (NYSE: TJX) and UnitedHealth Group (NYSE: UNH) (its two largest holdings). If companies want to be included in institutional funds like these, they need to start paying dividends.

Other times, companies simply have no better alternatives of what to do with the cash. Cigarette makers like Altria (NYSE: MO) generate a ton of cash flow every quarter. Yet because they serve a declining market that is experiencing declining volumes, it wouldn’t make economic sense for them to invest in adding more capacity. Instead, they create long-term shareholder return policies that agree to pay out their excess profits as a dividend (in Altria’s case, its dividend represents 80% of adjusted earnings).

Dividends are a great way to secure income, but they’re also a great way to compound returns over time. Reinvesting dividends allows investors to buy more shares of the same company — potentially at even lower prices during times of market turbulence. More shares that are each paying more dividends is a recipe for long-term compounding success. Dividends can even be a workforce retention tool, providing employees with your dividend-paying stock into a retirement account during their working years (while the dividend is reinvested and accumulating more shares) and then giving them an opportunity to use those cash dividends to pay for living expenses during retirement.

There are tax implications of dividends, though these can be offset through tax-advantaged retirement plans like Individual Retirement Accounts or ROTH IRAs. As a source of dependable income for shareholders, dividends represent a lucrative way that publicly-traded companies can appeal to long-term investors.

7investing has recommended several dividend-paying stocks, which we classify as an “Income” investing strategy. To see a full list of 7investing’s dividend-paying stock ideas, sign up for just $1 today and get full access to the filters of our recommendations page.

Already a 7investing member? Log in here.