Long-Term Investing Ideas in a Volatile Market

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

7investing advisors Anirban Mahanti and Simon Erickson discuss what the Fed cutting rates in 2024 would mean for stock market investors.

January 22, 2024 – By Simon Erickson

The Fed’s rampant rate increases have wreaked havoc on stocks in recent years. Yet we’re perhaps finally seeing a light emerge at the end of the tunnel.

Projections released by the Fed suggest that America’s central bank will reduce its Fed Funds target rate multiple times during 2024. The consensus interpretation of its latest dot plots are predicting three separate quarter-rate reductions. The Fed ultimately wants to reach a median target rate of 4.6% by the end of this year.

Falling interest rates are generally good for business. It allows them to raise capital and more attractive rates and to begin reinvesting in growth projects once again.

For investors in those businesses, falling interest rates translate into lower discount rates. This is the metric that institutional investors on Wall Street use to discount a company’s future profits to the present in their discounted cash flow models. When a discount rate falls (which typically happens when the Fed reduces the Fed Funds rate), future cash flows get discounted at a lower rate. And you ultimately end up with a greater present valuation and a higher stock price.

So let’s dig a bit deeper into why this all matters so much for investors.

In the inaugural episode of 7investing advisors Anirban Mahanti and Simon Erickson’s latest podcast series, the two discuss the state of the American macroeconomy and what it will mean for the stock market.

Anirban points out that the Fed tends to focus on the CPE price index — which tracks core personal consumption expenditures — as its preferred gauge of evaluating inflation. The CPE fell to 2.6% in its most recent reading. The Fed expects it to decrease even further: to 2.4% in 2024, 2.2% in 2025, and then 2.0% in 2026.

Source: YCharts

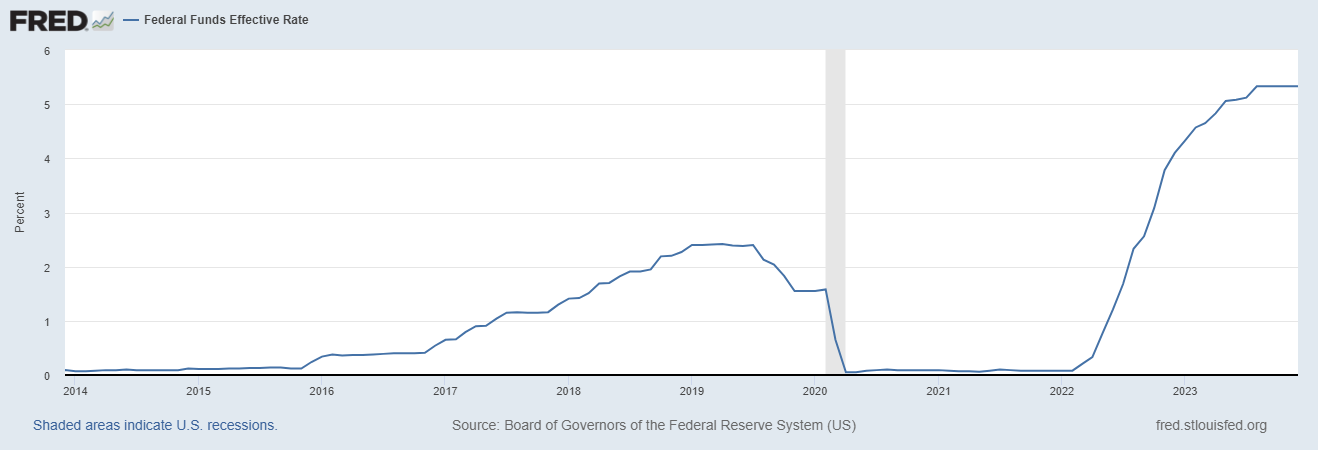

Simon went on to describe that the Fed responds to the inflation gauge by adjusting its target Federal Funds rate.

That rate currently sits at 5.25% – 5.5%, as of December 2023. Yet the Fed has suggested that it intends to reduce it by 75 basis points during 2024. Others in the financial media are suggesting the cuts could be even more aggressive, perhaps even as high as 150 basis points during the calendar year.

Source: St Louis Fed

All of this is very good news for stocks and for investors. And Simon and Anirban both believe that enterprise software could be one sector in particular that is poised to benefit in 2024.

In their next episode, they’ll dig deeper into that enterprise software sector and will recommend a few individual companies for investors to consider.

To subscribe for free to our 7investing podcast and have our episodes directly delivered to your Inbox, please join our free email list.

Publicly-traded companies mentioned in this podcast include Snapchat. 7investing’s advisors and/or its guests may have positions in the companies that are mentioned.

Simon Erickson 00:04

Hello, everyone, and welcome to this edition of our 7investing podcast where it’s our mission to empower you to invest into your future. You can learn more about our long term investing approach, and also see our top stock recommendations each and every month at 7investing.com/subscribe. My name is Simon Erickson, I’m joined by fellow 7investing lead advisor Anirban Mahanti. Anirban, we’ve started doing something new, which is where we’ve been offering conviction ratings for all of the stocks that we issue out there. And as part of this, were actually been issuing also some market commentary, which is kind of framing, you know, not only do we think these are the best stocks to buy, but why and what do we see bigger picture that’s going on out there. And so you and I have kind of collectively said, Maybe we should share some of that in the podcast, about how we’re thinking about various factors of the economy of the macro things like that. So we’re gonna give this a shot, see how it goes. Before we kind of jump into today’s first session, and it was always a pleasure chatting with you about these things.

Anirban Mahanti 01:04

Simon, I’m really excited about this in the sense that, you know, it’s, it’s really nice to just take a step back, and, you know, talk about what, you know, what does what’s happening in economy, how does that impact businesses? You know, where are businesses headed? And this is not really about trying to predict the short term, it’s, it’s, it’s trying to sort of gain a perspective. So you know, so you know, you and I are going to chat and try to lean on each other and understand, you know, sort of, you know, that get to the second level, third level thinking, and yeah, and we’ll see how it goes. And yeah, if people have got comments that they can email us or, you know, talk to us on Twitter, share your thoughts, tell us what you want to hear. And we’ll, we’ll try to work some of that in

Simon Erickson 01:46

Absolutely. Info@7investing.com if you want to email us and @7investing if you want to send us a Twitter message. And by the way, our advisor updates come out on the 15th of each month, that’s where you’re actually going to see the conviction rating reviews that we were discussing. Anirban, something that you and I both spent a lot of time thinking about is valuation. We incorporate different valuation models, and obviously these are sensitive to other factors outside of the company’s control. And so our first episode that we’re filming here is going to be a chat about inflation in the macro of what’s going on out there. So we wanted to kind of break this into first of all, how does the Fed think about inflation? Secondly, what what levers can it pull to actually influence inflation rates? And then the third being what does this actually mean for investors? You know, if you’re doing valuation models, if you’re looking at certain metrics, you know, what does this actually mean for investing in stocks? And so how about in your mind, if you could kick us kick us off? By kind of talking about? What is the Fed even look at for inflation? There’s so many different kinds of metrics and things that we can look at out there? How do they evaluate a lot of these things?

Anirban Mahanti 02:45

Yeah, thanks so much. And so you know, like inflation has is high, or has been high, everyone knows that. Because you know, if you’re going and spending, whether it is, you know, spending for your coffee, or burgers or whatever, you’ve been paying more, so you just kind of notice it. And the first thing to realize about inflation is that, you know, the way the Fed thinks about or anyone actually all economists think about inflation is really think about year over year trends, right? So how does inflation changing? Right? We have, you know, you’re not looking at, you know, the absolute price three years ago of a burger was five bucks. Now it’s maybe seven, it’s not probably going back to five bucks. But how fast is it increasing is what people are interested in. The common measures that we talked about here, is CPI is one of them, which is basically Consumer Price Index basically, is the basket of goods that is being followed, and their price increases on a year over year basis, right. Now, CPI wasn’t the central measure for the Fed until maybe up to year to 2000, or something like that. But they ran it steady, which basically says that CPI doesn’t really capture the full intent of how consumers are spending their money. And how, you know, the simple way to think about this is sometimes you can just do substitution of goods, right? So the CPMs is a basket of goods with a certain weight attached to each of them. If you do substitution, you know, something’s price goes up, and you can substitute it well, then that really doesn’t impact how people are spending their money. So to capture how people are actually spending their money. You know, there’s another end index that’s popularly followed, you know, which is consumer price expenditure, or CPE. Index, the Feds preferred metric is to look at CPE. Because it allows for that substitution, it follows a much wider basket of things. And, you know, if you read the FOMC minutes, you’d see that that’s, that’s what sort of they fall in fact, they would follow CPI for volatile items. But let’s just focus on CPE for the time being. What we’re really seeing the CPE is as those numbers have just been coming down in the last streaming off November was something like 2.6. You know, so year over year increase of 2.6%. That’s pretty close to the 2% sort of mandate that the Fed has. Right. The final, the final thing to remember with inflation is, and all of these measures is that, you know, sort of the the rate increases that the Fed had done in fed really tightened the market rates and increased interest rates, I mean, come that come to that in a bit. What that does is it reduces various types of expenditure that people have right to pull back on your spending companies reduce, you know, the capex, and things like that. All of that thing feeds in with a delay, right? If if the price increases, today’s 2.6, potentially means that inflation is really under control now. Now, of course, there’s a lag isn’t what I’m talking about. And and because of that lag, you know, you could you could say that, well, you know, the Feds job is mostly basically done. And this sort of that, what the Fed has implied in its last meeting that, you know, looks like we are sort of at the peak rate.

Simon Erickson 05:51

And Anirban, for those who are watching the video of this, you might be noticing that the sun is rising for you out there in Sydney, while it’s gradually setting for me out here in Houston. You know, you are in Australia, which is different the United States. But does it similarly follow the same inflation kind of path as the US out there? Or how do you think about inflation internationally?

Anirban Mahanti 06:26

Yeah, so different, almost every developed economy and developing economy, they all have their own, you know, bureaus that do the do the measurements, and sort of a similar trend is, is experienced by most of these countries. It doesn’t necessarily follow exactly like what’s happening in the US. But, you know, for for, like, for example, if you’re thinking about US businesses, I think, and in general for stocks, given that the, you know, the US dollar, and the the Fed is sort of, you know, the US dollar being the reserve currency, large, large chunk of the, the, the companies that are public are out in the list in the US, it’s useful to follow what the Fed is saying. But yeah, the general trends are the same, that inflation is falling everywhere. Some places more rapidly than the others. But the general trend is just there. And, you know, ultimately, we’re coming out of a severe economic destabilization to Smith was the pandemic, and closures and all of those things. And we had other issues alongside you know, there’s been, like, issues such as, you know, over ordering of things or shortage of supplies, you know, so therefore, you know, we have had cargo prices go up and cargo prices go down. But a lot of these civilizations eat, you know, what’s funny is, is the economy as a whole is such a system that it works in equilibrium and imbalance really well, but we turn a little disturbance. And this was not a little disturbing, it was a big disturbance. Things can be chaotic, and it’s been chaotic for some time. So, you know, I think it’s getting to the other side now.

Simon Erickson 08:07

Yeah, it certainly is. And certainly, Jerome Powell with the Fed has been one of the most memes, you know, loved/hated/whatever you want to depending on the on the moment of the macro. It seems like for so long, zero interest rate policy. You know, the Fed be held rates near zero, so to encourage growth of the economy very, very dovish, you know, very, very good for business, very, very pro growth. And then, of course, recently, in the last couple of years, like we’ve seen with inflation hitting 6% or 7%. They’ve kind of had to come back and say, Hey, we’ve got to raise rates to slow this economic train down a little bit. And that’s certainly what we’ve seen. It’s been a constriction of the economy. You know, when we were a year ago, looking at inflation rates at 6% or 7%, like you mentioned now 2.6%. Your most recent reading the expectation of 2.3 for that CPE, personal expenditure, reading and 2025 and the down to 2%, which is what Powell said he wanted to get to by 2026, there was a lot of discussions about, you know, is it working and generally accepted, at least right now, it seems to be that inflation is getting tamed a little bit more. We’ve talked about dot plots as a kind of segment to the second part of this is like what tools does the Fed actually have to control inflation. And we’ve seen that you certainly they’ve raised interest rates very, very quickly. Right now we’re at a target rate of about 5.25 to 5.5% for the Fed funds rate, which is the highest that has been really in about 20 years since really the year 22,002. And there’s a lot of discussion already that the Fed is going to actually pull back on on rates a little bit here in 2024. There’s already been a discussion of three individual quarter rate reductions down to around 4.5% or so or 4.75%. By the end of 2024. That’s on the table. That’s what’s being reported in the media, at least according to what’s been seen for the Feds dot plots. Of course, it’s totally up to Powell. He’s gonna look at data in every one of these meetings on a standalone pieces. But Anirban, what’s your take on this, I think that all things equal a reduction in the Fed funds rate and a reduction in interest rates would similarly reduce the discount rate that is used to value stocks, and all other things considered, that’s pretty good for investors going forward.

Anirban Mahanti 10:18

That’s right. So, you know, the Fed dot plots, basically, the median points, as you said, suggests three rate cuts, there are some people out there, some economists predicting up to six rate cuts, right. And it’s just like a circle that point before. And the reason this is important is, if you keep the environment tight, for too long, you can get into recession, right? Now you’ve got sort of this, really, like, you know, the holy grail of you know, you’ve tightened the economy. And if you haven’t slowed down, there’s enough jobs being created, there’s enough number of jobs being created, GDP is still growing, right. So all of those good things are happening, you know, you still have growth, you still have jobs, if you tighten too much, you might get into a recession, which is sort of the risk, right? So that’s why some people think that, you know, you might have more cuts, otherwise. But so basically, if you think of the feds, as you said, it’s between what, five, 5.25 5.25, and five, right? 5.5. So that’s the sort of risk free rate because you could just invest in a treasury and get that. So when you’re investing in the stock market, you want more than that, because you’re taking the risk of individual businesses and their performance. So you’d add another, let’s say, four or five percentage points to that, in terms of what you would expect in return. So that’s sort of our discount rate right? Now, this is not, you know, this constraint would consider other things like, you know, in in sort of theoretical jumps, we look at the weighted average cost of capital, we will think about the beta, but that’s it, no, Bailey is basically taking into account volatility, but if you let’s say, you’re not interested, the volatility part, you can just say that I, you know, this is what the risk free rate is, and I want to send premium over the risk free rate, right. And that, you know, depends on the individual investor, but collectively, the market decides, well, this is the sort of, you know, a bigger demand is much more on top of the risk free rate, as the interest rate goes down, I think one of the things that happens is that the, because the interest rate goes down, even if you keep your premium on top of the risk free rate fixed, your discount rate goes down, and as your discount rate goes down, so, which basically means that future interest, cash flows are getting a higher weight, right, because cash in the future is worth less than their discounted by the amount that you are using for the discount rate, as interest rate goes down, you know, the future cash flows become a word a little bit more today. Right. And what is interesting is that even a small one percentage reduction has a big impact on not just your, you know, the usually people would model the first 10 years of free cash flow and use terminal rate has an impact, not just on the first 10 years that you would explicitly maybe model, it also has an impact on the terminal growth rate. Right. And, you know, you could see valuation upwards of 2025 30%, depending upon the type of company and how much weight is there on the on the on the front end and the back end of the free cash flow, the valuations change, there’s a valuation uplift that that happens. There’s one other thing I’ll point out, which is, which is sort of, you know, if you want to be a bull, you can say that well, as interest rate goes down, cost of capital goes down, which means there’s more investments, right? It’s easier to take a loan, it’s easier to decide to finance a project is easier to get on to those projects that you want to go. But that causes more stimulus in the economy, which causes more growth, which could then drive earnings growth, right. So and if you think of earnings growth, you can also say that free cash flow, which is what we are really thinking about should also go up. As soon as there’s no recession. That’s like the best combination, because you have the discount rates going down, you should have earnings going or cash flow going up, because there’s more investment over time, that sort of thing and reducing the economy, assuming again, that you don’t get a recession because of the higher higher rates.

Simon Erickson 14:16

Yeah. Well, I agree. And maybe even another way of looking at that is the stock market is always forward looking right? There’s a short term forward looking element to this. And then there’s a long term forward looking element to this. The first is, you know, in 2022, a couple of years ago, and even parts of 2023, it didn’t matter if you had a good company or not. You are going to get hit by providing conservative guidance. You go out there and say capital is expensive and the economy is slowing down. We’re going to be very conservative on our forward guidance. And of course, what does the market do whenever you give conservative guidance? It hates you. So you go out there with sell off on earnings day because nobody wanted to say we’re going to be cautious out there. This is a short term, forward looking piece. Then as you just mentioned, you know, the discount rate that is used for all the sell side models, these price targets that are put out there by institutional analysts that if they are, if you are lowering the discount rate, you are lowering the discounting of those future cash flows. Which is increasing the valuation of them over time. So that’s kind of the short term expectations game, the long term, actually weighting of the cash flows of a business, both are favorable, when the Fed funds rate and the discount rates that were used, come down. So all things considered, this is the good time, this is finally a good time to be investing, because it’s sometimes tough to beat the Fed and a tough macro like that.

Anirban Mahanti 15:34

That’s right. Yeah. Like, I mean, again, like they just, you know, when they when someone is investing in individual companies, I guess the important thing there is valuation of, you know, the stock could a company could already be overvalued, right, or could be undervalued. But in general, the the point would be that, you know, one needs to be aware of the discount rate, because the discount rate has an impact on valuation. Right. And, and you can, you know, some simply in one could just do a separate spreadsheet, for example, to work out, you know, the impact that the discount rate has, like a small 1% reduction, I was just playing around with a spreadsheet and said, Well, you know, let’s assume that my free cash flow at the beginning of the year is, is a billion dollars and the children model for the first 10 years. And if I wouldn’t say 15% growth for the first year, this is just theoretical, and then a tonal rate of 3%. If I go, if I have a 12% discount rate on that, my fair value works out to be something like $265, if I change the discount rate to 11%, just want to say drop, it goes up to $305. This is real impact. That you know, that 1% can result in that much difference, right? It’s just again, it’s something that you can play on your spreadsheet, you realize that he has a discount rate has a significant impact on on how we value companies. And of course, this is ignoring the potential impact that has already it can have on driving earnings or cash flow growth. So yeah, I think it’s important for people to consider, of course, you need to consider that it could be the company that you’re looking at is already significantly overvalued, or significantly undervalued. Yeah.

Simon Erickson 17:11

And speaking of saving, significantly undervalued, this is something that actually went into our team recommendation for December, we’re not gonna reveal the name of that, we want you to sign up for 7investing to see it. But it was one of the neurons picks, it was one of his recent Best Buys. And it just made a great case, he was extremely undervalued when you’re looking at the business potential out there.

Anirban Mahanti 17:50

Well, I mean, I think there’s a range of so that even in each sector, the range of companies that I think we can consider, right, so if you think about the tech sector, for example, the tech sector, especially enterprise, SAAS, they’ve been hitting, they’ve been hit pretty badly, largely, because a lot of these companies have most of their growth baked into the future. And as the discount rate went up, that valuation compression, that’s pretty significant. Right now, that’s not to say that some of these companies probably would overvalued at some point in time. So that’s something to consider is what has happened is sort of a double, double, you know, sort of double action has happened, as the rates went up, all these companies actually pulled back on how they were spending, you know, it’s it’s no longer go go go go go growth at any cost people actually, companies have become really focused on operating leverage. So as long as they maintain their operating leverage, actually good economic environment to lower sort of, you know, fed interest rate environment is positive, because it sort of helps that growth because, you know, ultimately, enterprise SAAS basically means that you’re selling to other businesses, and those businesses feel confident about investing in the future, then you sort of see that they’re making those digital transformations. So I think digital transformation, overall should pick up. That’s my guess, you know, there’s been a you so see that, I guess, in the early phases of that you see it in the hyper scalar spent, so most of the hyper scalar have seen contraction of spending. And that’s because what they’ve been trying to do is, you know, if companies have committed to spending billions of dollars with them, they’re trying to make more happen with those billions without committing to further billions, right? So there’s been trying optimization, but what the commentary right now is that those optimizations are probably coming to, as far you know, to the end as possible, like you’ve, you’ve squeezed out as much as you could. And now to get to the next phase of your digital transformations, you really need to spend time, right? So I think, you know, So we’re coming from a phase of really solid optimization to a phase where you’re gonna get sort of the next leg of those digital transformations happening. So I’m quite positive about digital transformation in general, I think digital transformations is great. But you could you know, even consumer discretionary is any basically company that you think has been hit hard, because a lot of earnings should see benefit from the reduced rates?

Simon Erickson 20:28

Yeah, I would agree. Anirban. It’s kind of the perfect segue and teaser for our next conversation that you and I are going to have, which is going to be about enterprise software, right? There was a lot of companies spending a lot of money in 2021, right Snapchat, or digital advertising wherever you want to consider it. And then now, like you just mentioned, operating leverage, you know, cash flows, mission critical, who’s actually going to be embedded in this long term trend. That is the digital transformation. I think that’s going to be a great topic for our next conversation. So for Anirban in Sydney. Good morning to you. I hope you have a wonderful day. And thanks for being part of this episode of the 7investing podcast. Thanks everybody, for tuning in. This time, we’ll be again next time we’re gonna be talking about enterprise software, and next conversation between the two of us. We hope that you’ll join us for that one as well. We hope you have a great week and we’re here to empower you to invest in your future. We are 7investing!

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

Anirban and Matthew were joined by Alex Morris, creator of the TSOH Investment Research Service, to look at seven former market darlings that have taken severe dives from...

On episode 5 of No Limit, Krzysztof won’t let politics stand in the way of a good discussion - among many other topics!