Anirban discusses why Confluent is worthy of a position in your watch list ...

October 24, 2022

Confluent (NASDAQ: CFLT) is the “data in motion” company. Its software connects data producers with consumers in a way that supports seamless and scalable message passing.

Jay Kreps, Neha Narkhede, and Jun Rao, the co-founders of Confluent, while working at LinkedIn in the early 2010s, were searching for a scalable message-passing interface for connecting various systems. The trio couldn’t find an off-the-shelf system. So, they decided to build one! This system was released as Apache Kafka, an open source project, in 2012.

Apache Kafka soon became the real-time message-passing interface of choice among Fortune 500 companies. Seeing the success of Kafka, Kreps and the team decided to take Kafka to the next level by offering it “as a service”. They re-architected Kafka, made the solution cloud-native and enterprise-grade, and today have two offerings. One is the Confluent Platform, which is an enterprise-grade self-managed offering. The other is a fully managed cloud offering called Confluent Cloud. According to Kreps, Confluent’s offering today is 10x more powerful than open source Kafka.

Source: Confluent Presentation, October 2022.

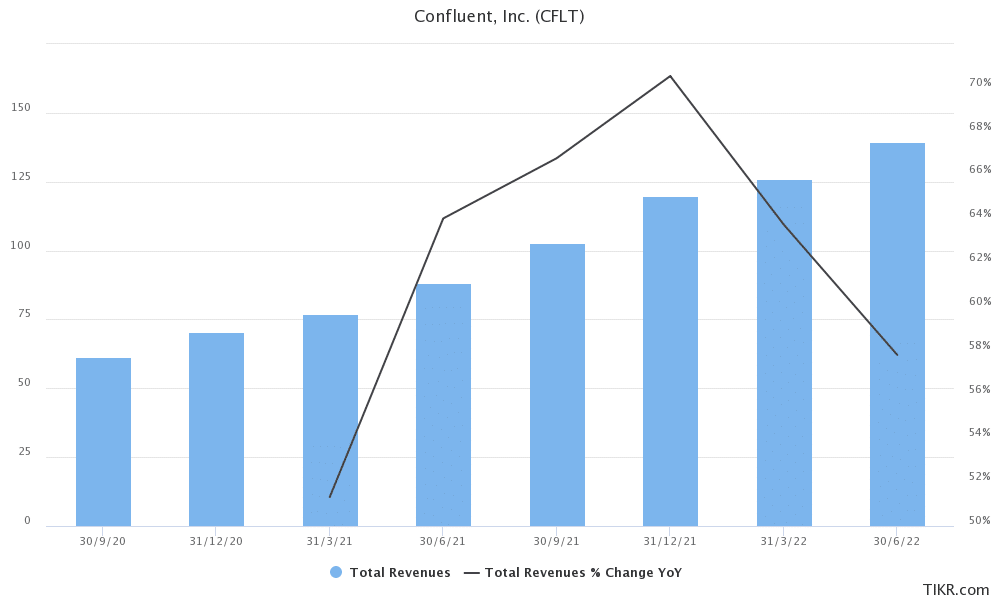

Source: Quarterly revenue & growth, data & graph from Tikr.com.

The company estimates its total addressable market at $60 Billion/year. With a trailing twelve-month revenue around $500 million, the company has much room for growth. Over the long term, Confluent has the potential to become a deeply ingrained data layer in the modern technology stack.

Confluent’s results demonstrate its ability to deliver strong growth, with revenue increasing 58% year-over-year to $139 million. Impressively, Confluent Cloud grew by 139% to $47 million. The company’s cloud offering will weigh on its margins over the medium term, but it should help Confluent become entrenched over the long term. As a sign of future potential, contracted revenue (remaining performance obligation), which will be recognized in the future, was up over 80% to $591 million.

Confluent as a young business is yet to generate operating profit or positive free cash flow. GAAP operating loss in the second quarter of 2022 was $117 million, while the loss on a non-GAAP basis was $47 million. Both represented improvement over the prior year, which illustrates the underlying operating leverage in the business. Interestingly, Confluent, as the data infrastructure layer provider, is unlikely to be easily turned off or replaced once deeply embedded in an organization. In other words, Confluent will enjoy very high switching costs.

As a software business, one that is building scale, I see strong free cash flow potential as the company moves past a tipping point. Management has indicated 2024 as their target for achieving non-GAAP profitability. With cash and equivalents of around $2 Billion, the company appears to be in a good position to hit that tipping point.

Confluent’s Initial Public Offering (IPO) was at $36 back in June 2021. The stock experienced a bull run along with the remainder of the software stocks but has recently seen its valuation get crushed. It is currently trading well below its IPO price.

Its peak valuation on an enterprise valuation (EV) to trailing twelve months sales (S) basis was more than 70. Currently, the EV/S multiple is around 13. Assuming the company grows its sales at a compound annual rate of 35% for the next four years, we expect annual sales to be a tad below $2 Billion. Let’s assume the EV/S multiple contracts to a modest 6-times; that would imply an enterprise valuation of $12 billion, representing a nice double in four years.

Of course, lots could go wrong, given the young nature of the business. Still, the valuation for those with a long term outlook appears undemanding provided the company can grow at a moderate pace and capture around 3% of its current market opportunity.

For full disclosure, I have a position in Confluent and have added to it recently. Confluent, in my view, is a compelling opportunity for high-growth, risk-tolerant investors and deserving of a position on the watchlist.

If you enjoyed this article, you might find the following articles interesting:

Already a 7investing member? Log in here.