Tesla “the Car Company” is Worth $104 Per Share. Here’s Why FSD Really Matters.

Tesla's stock has a lot riding on its FSD future. Will Elon successfully navigate the opportunity?

May 14, 2024

This article is Part 1 of a two-part series. To see Part 2, click here

Tesla (Nasdaq: TSLA) is one of the market’s unique “battleground stocks”. People passionately either love it or hate it, the financial media jumps from being euphoric to downtrodden, and the institutional price targets are all over the map.

For two weeks now, I’ve taken on a project to determine what Tesla is fundamentally worth. It’s involved social isolation, lots of late-night research, and an endless supply Dunkin Donuts coffee pods. But I’ve finally come up with a value of what Tesla is worth as a car company.

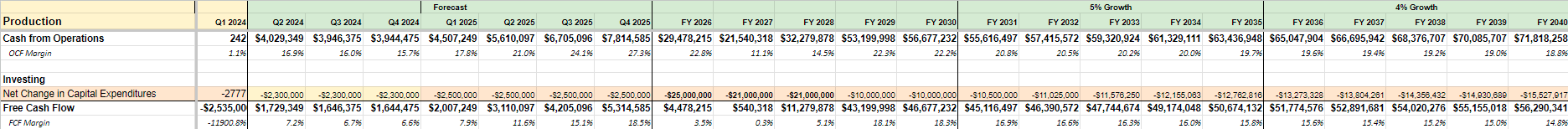

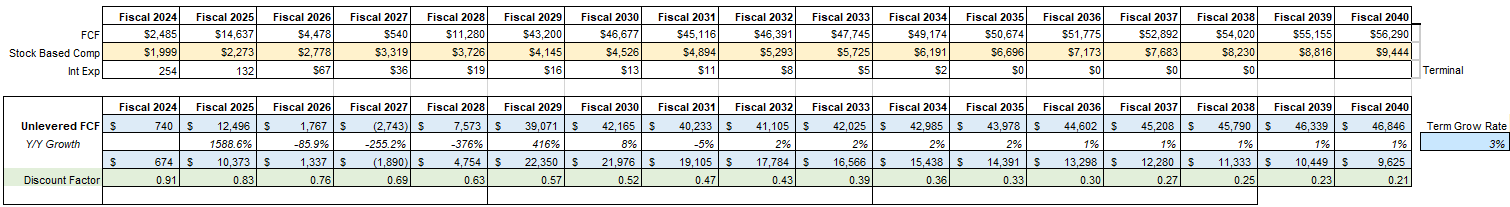

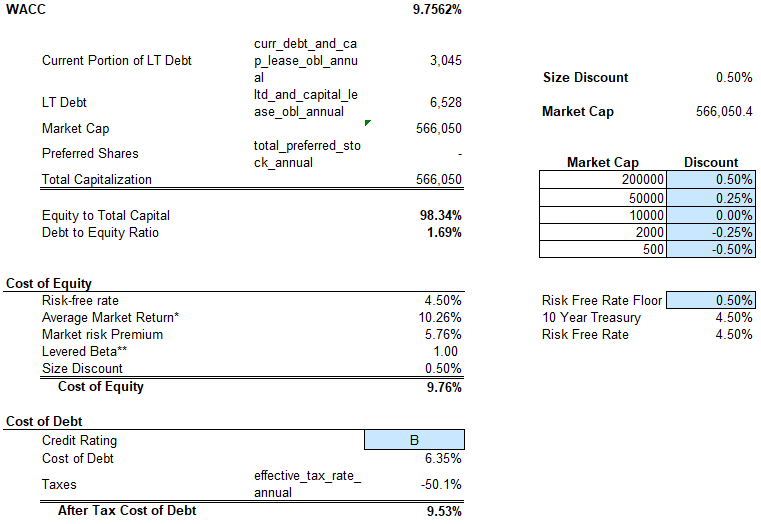

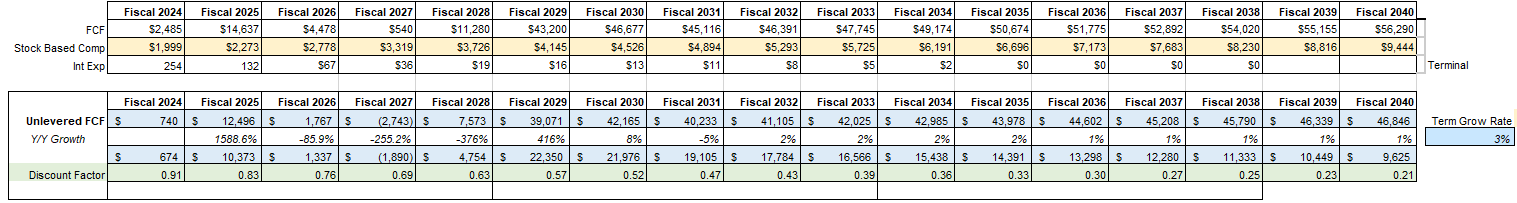

Before I explain why that italicized phrase is so important, let’s first introduce my Discounted Cash Flow methodology. A DCF estimates all of a company future revenues, operating costs, and capital expenditures and then discounts its free cash flows back to the present day. The final answer — presented as a price per share — represents the intrinsic value of Tesla’s stock based on all of the assumptions used in the model.

No model is ever perfect. It’s hard enough to predict what a company’s earnings will look like next quarter, much less what they’ll look like in 15 years. But for battleground stocks like Tesla, which has ranged from $138 to $300 per share during just the past year, it’s a perfect way to put a stake in the ground and to determine what’s a fair price to pay.

Just as I’ve done for Rocket Lab, Coupang, and The Trade Desk, I’ve purposely erred on the side of caution when building out this model. Rather than shooting for the moon and creating a best-case scenario that would likely never happen, I’ve tried to objectively evaluate Tesla’s business and come up with its most-likely future path.

In Musk We Trust

A good part of Tesla’s future lies with the decisions of its CEO Elon Musk, who revealed in his secret Master Plan eighteen years ago how he wanted Tesla to be the vehicle for Earth to escape its dependence on fossil fuels and to accelerate into a more sustainable future.

Yet it’s a fine line between genius and madman. And it’s no surprise that the yin and yang of Musk’s persona greatly contribute to the stock’s volatility.

Those who love him would describe him as equal parts visionary and executor; outlining the path for humanity and working hundred-hour weeks in the Gigafactories to ensure things are operationally perfect. But others believe Musk is a huge risk to Tesla, whose cavalier attitude and often immature social commentary can sometimes get him and the company in big trouble.

Several investors will buy and hold Tesla for as long as Musk is at the helm. Others will avoid the stock entirely unless he steps down.

But for the purposes of this DCF exercise, I’ll use Elon as an input based on what I expect he will do with Tesla. The auto industry is notoriously competitive and capital-intensive, which is generally a bad combination for long-term investors. Yet Elon’s passion for his craft and his technical step-ahead of others puts Tesla in the driver’s seat when it comes to incorporating AI into cars in a way that is making Tesla look less like an upfront automaker and more like an ongoing software company.

So for all of the euphoric highs, the downtrodden lows, the two-party politics, the international government subsidies, the egos, the trade relationships with China, and the vast sea of known unknowns, here is my objective opinion of what Tesla “the car company” is worth.

Before we get into the trenches of my entire model, I’d like to quickly promote our 7investing service.

This article contains institutional-grade research and is only possible to be published for free because of our generous paying subscribers. If you find value in this article, please consider sharing it on social media to help our brand awareness or joining 7investing for just $1 to get similar research reports on all of our official stock recommendations.

Your 7investing membership also includes complete access to our Community Forum, where our advisors and other investors are discussing stocks on a 24/7 basis.

Now, let’s roll up our sleeves and get into the details of Tesla’s electric vehicle future.

Inputs and Assumptions

Revenues

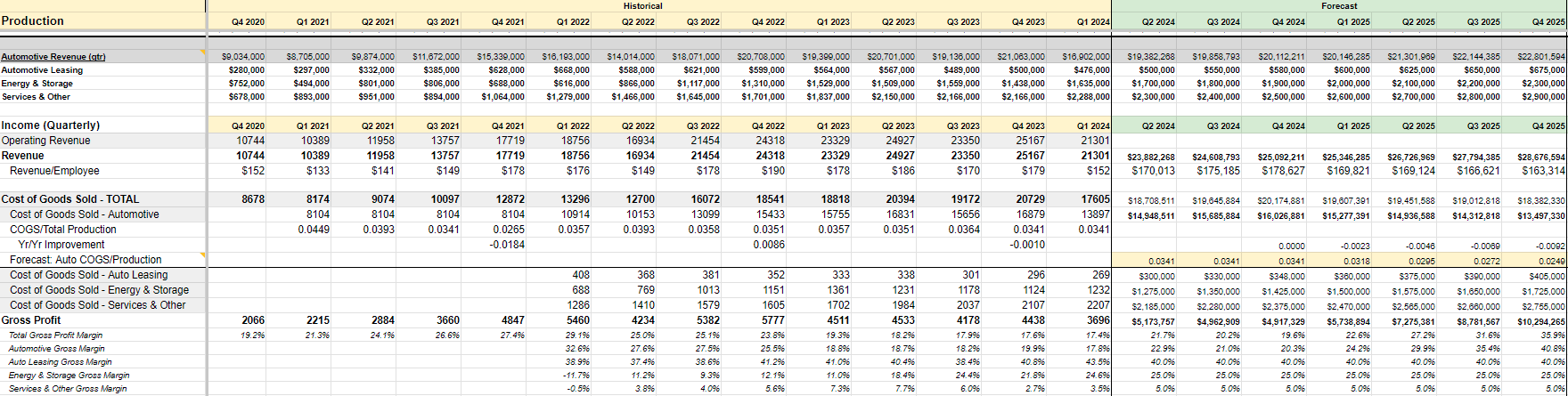

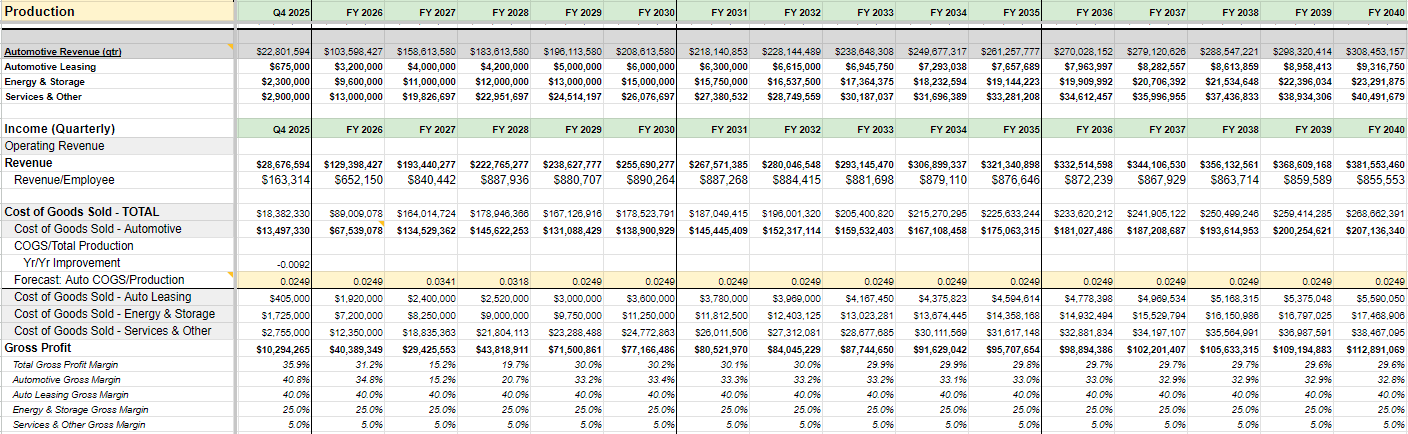

In my previous two articles, I revealed how Tesla is facing short-term speedbumps when it comes to demand — but also that I expect things should vastly accelerate by the end of the decade.

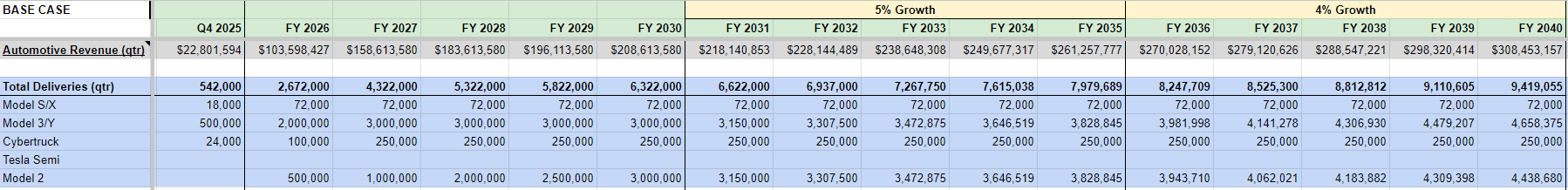

I broke the revenue forecast into three parts:

1) Near term (2024-2025) – This is where we have the most visibility into. Tesla is ramping up the Cybertruck in America and has been selling the Y nearly at production capacity from Berlin and from Austin. But it’s also in the middle of layoffs + a hiring freeze, as it missed delivery estimates last quarter. It’s also seeing significant pricing competition in China. I estimate Tesla will sell 2 million total cars and generate $86 billion in Auto Revenue in 2025.

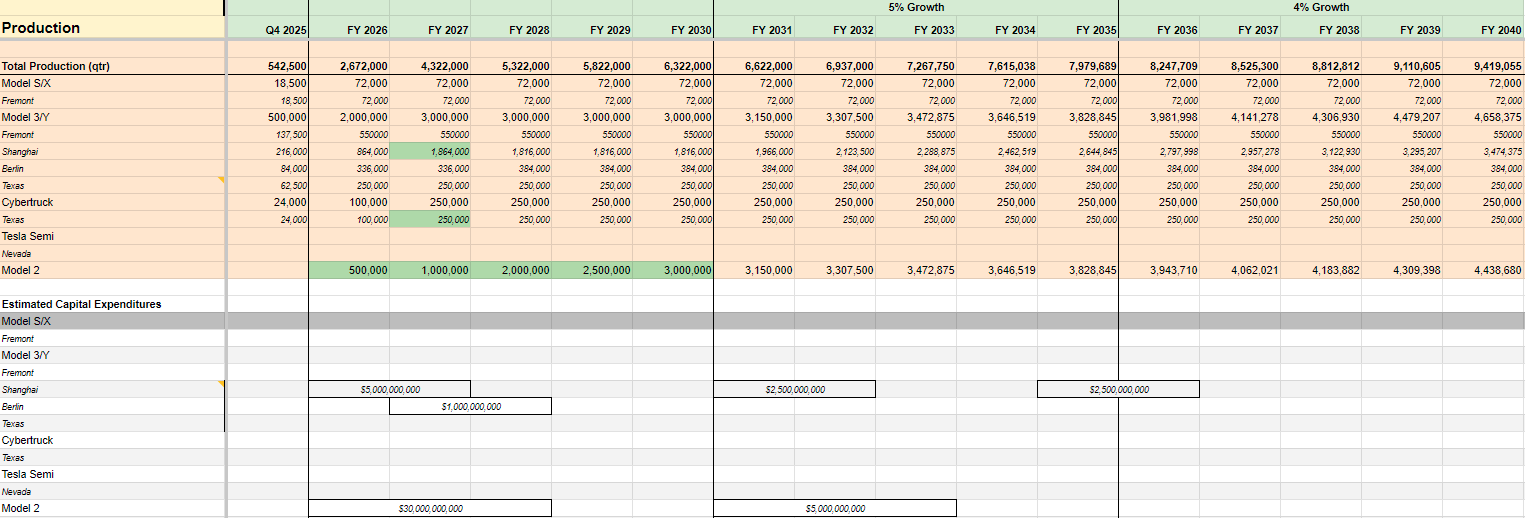

2) Mid-term (2026-2030) – In the mid term, I expect Elon will focus primarily on re-establishing market share of the Model 3 in China (at the expense of pricing) and boosting Shanghai’s capacity. He’ll also introduce the “Model 2” (which has taken several different names), the mass-market EV that will sell for ~$25k in the United States. Based on Tesla’s traditional history of how quickly it can scale, I think it will sell 500k Model 2s in Fiscal 2026, 1 million in 2027, 2 million in 2028, 2.5 million in 2029, and then 3 million in 2030.

3) Longer term (2031-2040) – The longer term is by far the most difficult to model. But knowing Elon, I think his focus is going to be on selling as many Model 2 cars as possible, and then loading them up with FSD and/or AI features to accomplish his bigger-picture Master Plan of breaking free of fossil fuels. I believe Tesla will continue to invest in its Gigafactory capacity (especially in Austin) and will aggressively put its foot on the accelerator when it comes to production, selling almost 10 million vehicles in 2040. I’ve sanity-checked this against the global auto market, which is similarly embracing EVs instead of ICEs. Tesla’s 9.4 million EVs sold in 2040 will account for 12% market share of the 76 million EVs sold; which is 50% of the 152 million total light vehicles sold globally that year.

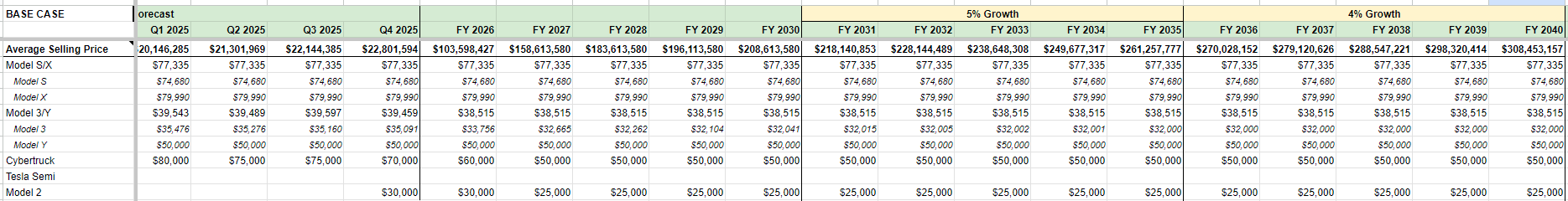

Regarding pricing:

1) I expect Tesla will get the fully-baked ASP of the Cybertruck down from $82k today to $50k by 2027.

2) Similarly, due to competition in China, the global ASP of the Model 3 will fall from $36k today to $32k by 2028.

3) I’m modeling the Model 3 to initially be priced at $30k in 2026 and then $25k in 2027 and beyond. Both of these pricing declines are offset by production volume increases. Essentially, that Tesla is passing on the savings from more efficient production to consumers through price cuts.

Of course, increasing sales and deliveries don’t come for free. They require heavy capital expenditures on the Gigafactories, as well as labor to run them.

In the “Operating Expenses” tab of my model, I estimate the costs Tesla will incur in order to keep up the production capacity outlined above. I first looked at the historical periods of Tesla’s expansion.

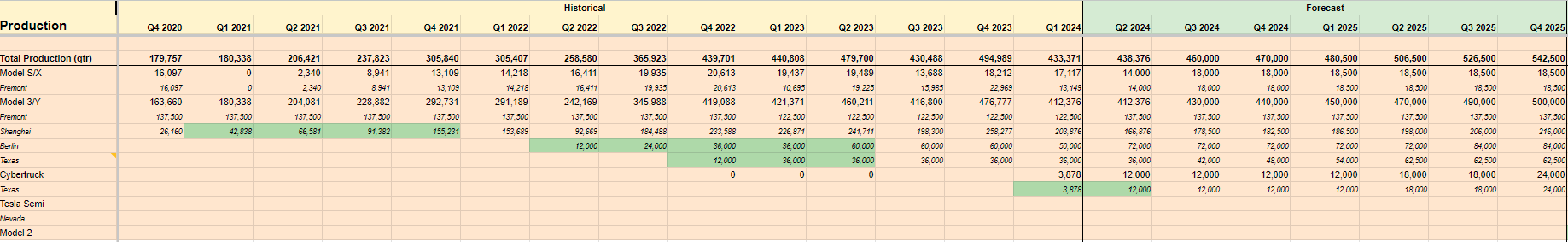

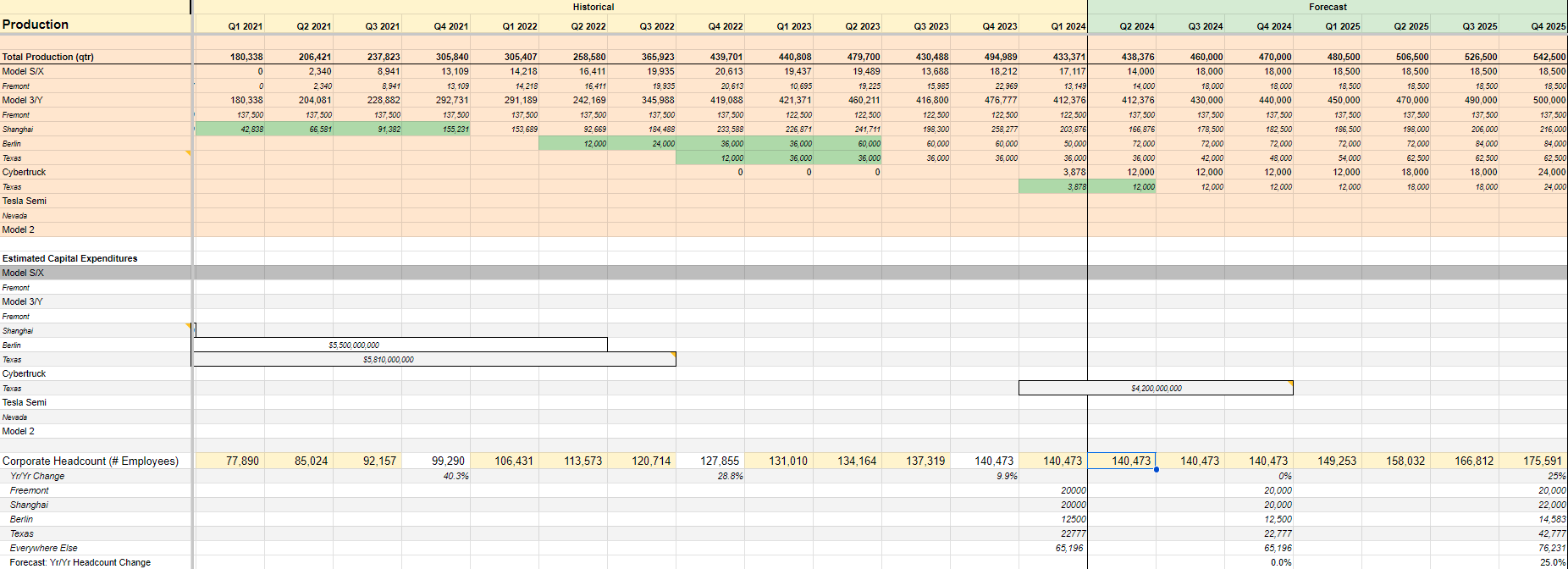

As an example, how much did it spend on CapEx and how many people did it hire to increase the capacity of the Model 3 in Shanghai from 26k cars in Q4 2020 to 155k cars just one year later?

The same thing with the ramp up of the Model Y in Berlin in 2022 and in Texas in 2023, as well as the Cybertruck in Texas in 2024.

Gigafactories Cost Gigamoney

One thing that’s nice about Elon is that he’s pretty transparent about how much he spends on things. Tesla spent $2 billion on the Shanghai Gigafactory, which is significantly less than what it costs to add the same level of capacity in the US or in Europe. It also spent around $5.5 billion in CapEx on Giga Berlin and has spent (thus far) $5.8 billion on GigaTexas. Elon expects the ramp-up of the Cybertruck and the Y will require another $4 billion investment in the Lone Star State.

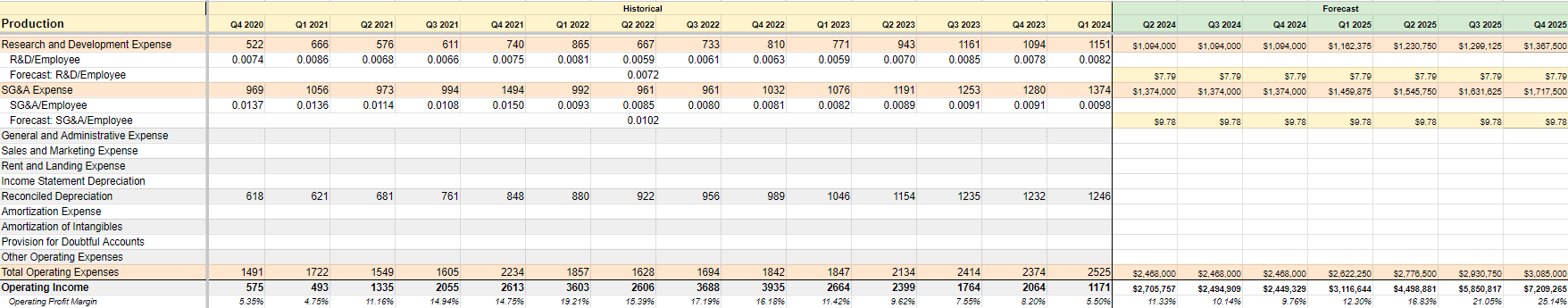

In terms of employees, Tesla had 70k employees at the end of 2020, 99k in 2021, 127k in 2022, and 140k in 2023. It’s hitting the brakes right now, with layoffs across the board and hiring freezes in many locations. I’m projecting Tesla remains at 140k employees at the end of 2024. But then hires aggressively — up to 175k by the end of 2025 — to gear up for the production of the Model 2 in Austin.

I am forecasting for Gigafactory Texas to increase from 22,777 employees today to 42,777 at the end of 2025. Directly related to the doubling of Cybertruck capacity and also getting ready for 500,000 Model 2 units to be produced in 2026.

Furthermore, the CapEx required to roll out the Model 2 from the Gigafactory Texas will be MASSIVE. It’s already cost $5.8 billion just for the Model Y and Cybertruck capacity, with Elon pledging another $4 billion. That’s a $10 billion total CapEx investment, just for these two models. Tesla hasn’t throw any numbers out yet (at least that I’ve seen). But I am estimating the full capital investment for Austin to manufacture 3 million Model 3 units per year by 2030 will be $30 billion.

It will spread this investment out over three years — from 2026 to 2028 — as it gradually ramps up production. The employee count will similarly rise, from 22,777 today to 42,777 by 2025 to 80,000 by 2030.

I expect headcount will grow slower in the out years, just 5%/year in 2031-2035 and then 4% in 2040. By 2040 — 15 years in the future — Tesla will have 445,000 employees all across the world. That’s more than twice the number of total employees that Ford or GM has today.

Costs of Goods Sold

The next line-item on the Income Statement is Tesla’s Cost of Goods Sold (COGS). These are costs incurred directly from producing the vehicles. I’ve calculated COGS/Total Production for the past few years and found that it gradually declined over time.

This is due to two factors:

1) The components are less expensive for a lower-cost vehicle. IE the Model 3 costs less in materials and components than the Model S.

2) Manufacturing becomes more efficient with higher production volumes, as downtime is reduced, fixed costs are spread across more units, etc.

I’ve accounted for both 1) and 2) by gradually reducing the COGS per Unit Produced during times of ramping up production. I modeled the operational efficiencies of the ramp up of the Cybertruck in Austin and the Model 3 in China to be similar to those captured during the first expansion of the Model 3 in China during 2021-2022 and of the Model Y in Berlin in 2022-2023. This “learning curve” reduces the COGS per vehicle over time.

- Auto Leasing: 40% gross margin

- Energy: 25% gross margin

- Services: 5% gross margin

This is a conservative assumption, as Tesla will likely find ways to boost the margins of these segments over time. Especially those that are tied to greater production volumes, such as Leasing and Services.

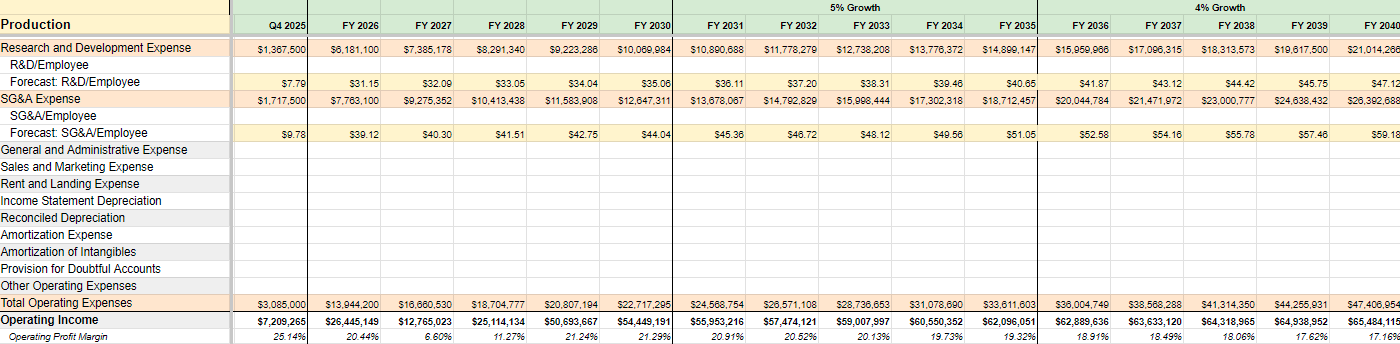

Operating Expenses

R&D and Sales & Marketing are tied most closely to personnel. It includes salaries and stock-based compensation; which both increase as you hire more people. Right now, Tesla is recognizing an expense of $31k per employee as “R&D” and $39k per employee as “SG&A”. Note that this doesn’t matter where the employees work; the denominator is the total employee headcount of the whole company. So a combined $70k per employee for both of those overhead operating expenses.

I’m modeling salaries to rise at 3% every year; roughly in line with GDP. Tesla’s operating profit margin was in the mid-teens in 2022 and has dipped to only 6% in this current quarter. I have it rising back to 20% by 2026, and settling down to 17% by 2040.

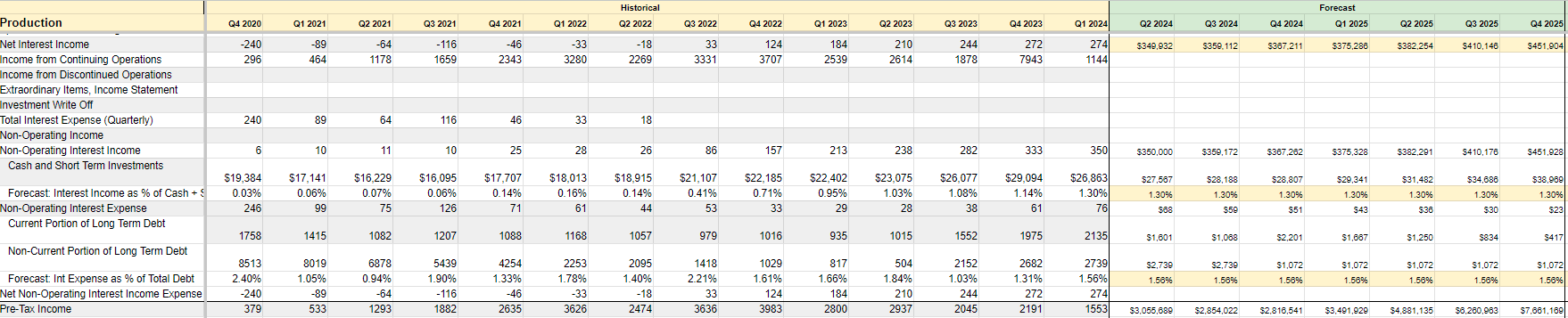

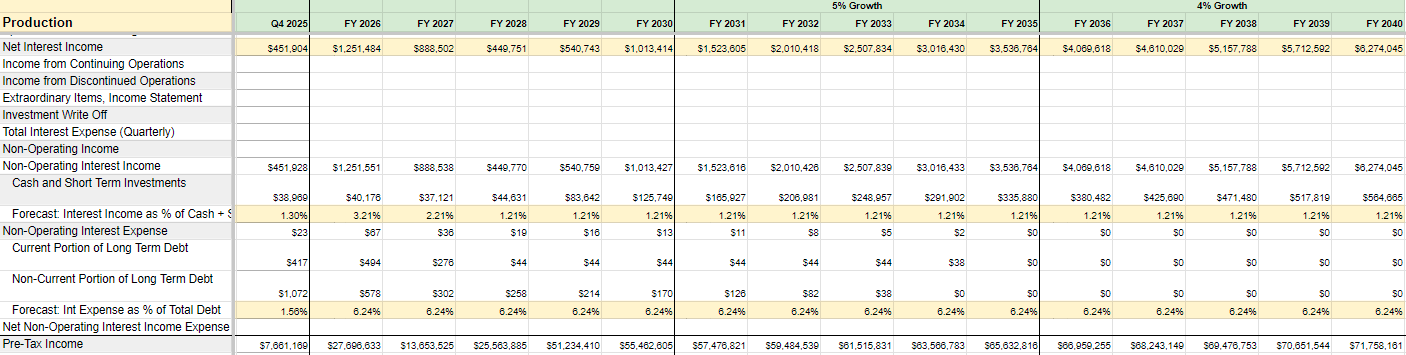

Tesla’s Piggy Bank is Expanding

One other factor that I didn’t realize is a big deal until now is how much cash Tesla actually has. It has $27 billion in cash & short-term investments right now! Before Q1, it was free cash flow positive for the previous 11 straight quarters. That includes even after paying all of the capital expenditures required for the Gigafactory expansion. This gives Tesla a competitive weapon — that it has plenty of cash on-hand to fund its EV volume expansion that other automakers who are newer to building out their EV programs do not enjoy. Interestingly, Tesla doesn’t really need to put this cash to work until the Model 3 China expansion and the ramp-up of the Model 2 in Texas. In the meantime, it collects Interest Income.

That’s highly-lucrative right now, while interest rates are high and Tesla’s collecting an overall APR of 5.2% on the cash in the bank. I don’t think these high interest rates will continue for too long. The Fed is already talking about rate cuts in 2024. I project that Tesla continues to earn its current rates for another year for its CDs in the bank. But that it will only earn an APR of 3.2% in 2026 and this will drop to 1.2% by 2028 and beyond.

Tesla also holds a little bit of long-term debt, which it’s paying down every year and also is incurrent interest expense on. I’ve accounted for both the Interest Income on Tesla’s cash and the Interest Expense on its debt in Rows 89-107. Including even the end-of-year adjustments to its cash balance. (I did promise you I’d leave no stone unturned!)

Stock-Based Compensation and Non-Cash Adjustments

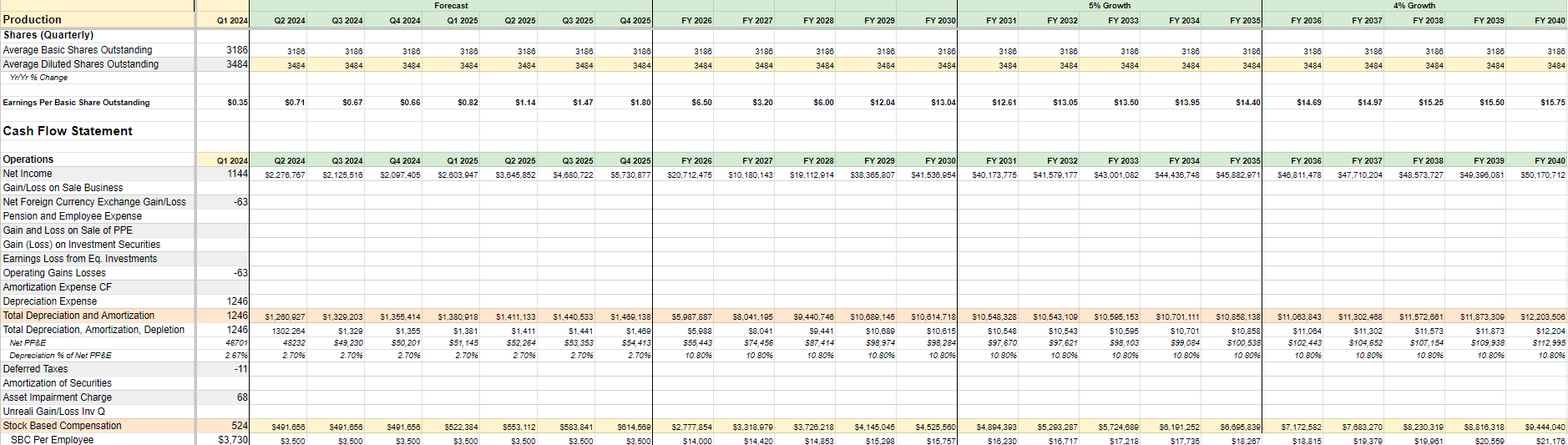

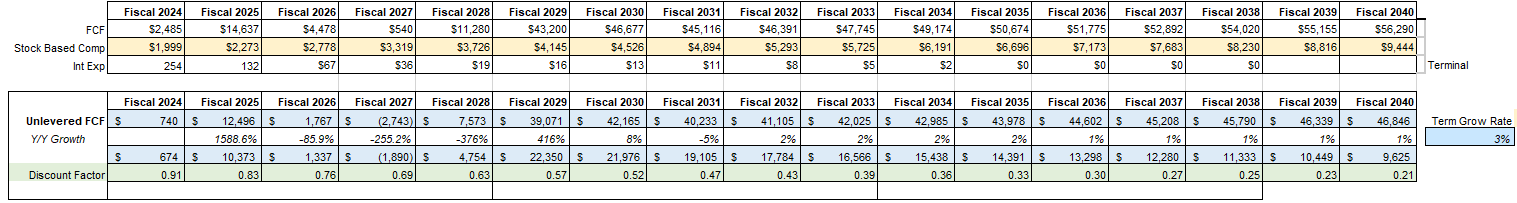

That brings us to the bottom line: the Net Income line-item of the Income Statement. I’m estimating that Tesla will recognize $41 billion in net income in 2030 and then $50 billion in 2040. In order to keep its share count fixed at 3.5 billion fully-diluted shares, it will need to spend cash to offset its stock-based compensation (more on that in a minute).

I used a 17 year growth window and assumed a terminal growth rate of 3% for the cash flows beyond 2040. I then discounted all of those future cash flow back to the present.

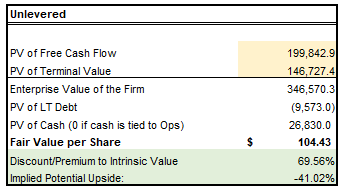

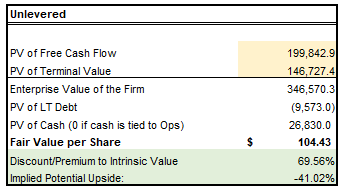

So What’s Tesla’s Worth?

So now that we’ve gone through all of the inputs, let’s circle back to that punchline. I estimate Tesla’s present equity value is worth $104.43 per share. This represents the fair value of what Tesla’s shares are worth today.

But let’s get back to what I said at the very beginning about this being for Tesla the car company. It’s important to recognize that this DCF valuation model includes zero contribution from two of Elon’s favorite future projects:

- The self-driving commercial Tesla semis

- The FSD Tesla Robotaxi fleet

Both of those are very small today. Aside from a pilot program with Pepsi and the few drivers who paid upfront for all future FSD upgrades, neither of this is currently contributing any meaningful amounts of revenue or cash flows.

Yet much of the hard groundwork that Tesla is laying today could set these up to be massive money-makers in the future. If deployed at scale, the recurring revenue collected from either a commercial fleet or an autonomous ride-hailing network could generate far more than Tesla could collect upfront from selling cars or from ongoing repairs or maintenance.

The FSD service today — which isn’t fully-functional or even allowed in many locations — is priced at $100 per month per vehicle. That would represent an extra $1,200 per year that Tesla could collect for each car it sells.

Quantifying what that commercial fleet and autonomous network will likely be worth will be my next task at hand. Stay tuned to see the present value of Tesla “the AI company”.

I’ll be sharing all of those future updates on our 7investing Community Forum. I’d love to invite you to join in on the conversation.

Want to discuss Simon’s assumptions on Tesla directly with him and with other investors?

Simon, Thanks so much for going through in detail your DCF process/analysis of Tesla and other companies recently. Your thoughts and assumptions provide some very valuable insight into analyzing and valuing companies. I can’t wait to see who you work on next, after a well deserved break! Thanks again for continuing to provide value to the 7Investing community – along with the rest of your team who provide some really valuable and honest insight into the companies they follow. Best value for the money as far as I’ve seen for a general stock selection service.

“Simon, excellent work. This discussion reminds me of the INNOVATORS DILEMMA and why it is so hard to frame civil discussion around such a disruptive company. Good job all!””Thanks Simon! Really cool to watch you do this process.”

“Simon, this is fantastic work! I wonder how long do we expect Tesla to benefit from regulatory credits?”

“As I go through all this information, I will have to give 7investing credit, you are extremely transparent and you certainly don’t try to sugar coat your stock picks.”

“Thanks for doing this. So much work goes into these models, that this kind of financial calculus on individual stocks is worth the price of admission by itself.”

“Thanks a lot for working through this publicly, really an excellent exercise.”

“Thanks for the modeling!”

“Thanks for the hard-work, 7innovator! Would be interesting to see if this impacts the conviction rating..”

These are actual posts from actual members in our Community Forum. Click here to join 7investing’s Community Forum today!

Already a 7investing member? Log in here.