What we think about ASML

Advanced Semiconductor Materials Lithography was founded 40 years ago as a joint venture between ASM International and Philips.

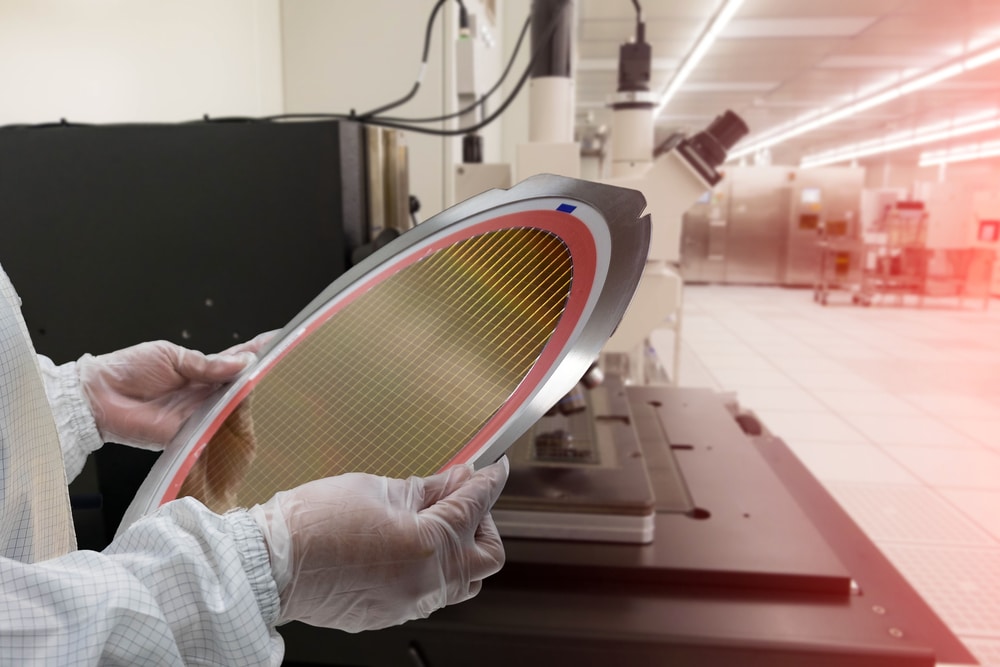

The world’s first wave of semiconductor chips were originally manufactured by the same companies who designed them. But when ASML introduced its lithography technology that exposed silicon wafers to concentrated ultraviolet light to etch out very small transistors, it allowed integrated circuits to be mass produced much more efficiently at third-party fabrication facilities (“fabs”).

ASML’s original wafer stepper prototype, the “SIRE II”, in 1980. Source: ASML he lithography process went on to become infinitely more complex during the next four decades. It now involves using some of the world’s most powerful lasers to superheat tin atoms into a plasma at a temperature that is 40 times hotter than the surface of the sun. The machines each have more than 100,000 components and take two years to fully assemble and deliver.

ASML’s newest EUV machine, the TWINSCAN EXE High-NA, in 2024. Source: ASML SML has today become a juggernaut who generates $30 billion USD in annual revenue and churns out $5 billion in cash flow every year; both of which have quadrupled in size during the past decade.

Its specialized equipment broadly falls into two categories: more-mature deep ultraviolet (DUV) and more-emerging extreme ultraviolet (EUV) lithography. DUV systems are the workhorses of the industry that use larger light wavelengths to produce chips in greater volumes, while EUV are the cutting-edge systems that are needed for the smallest and most powerful chips. DUV accounts for around 43% of total revenue and EUV accounts for 32%.

The machines can run for several decades. The company also generates 25% of its top line as “Installed Based Management” service revenue.

ASML is a monopoly that is estimated to control 90% market share of all DUV systems sold globally and 100% share of all EUV systems. It is headquartered in Veldhoven, Netherlands and employs 42,000 people.