The 7investing Key Takeaway

The stock market has been giving investors plenty to worry about lately.

More than half of the Nasdaq’s listed companies have now dropped 50% or more from their highs. Inflation, rising interest rates, and international conflicts are causing valuation multiples to fly all over the page. “Fear, uncertainty, and doubt” indexes are peaking, as many stocks are moving 30% up or down in a single day. The short-term narrative has been characterized by trading losses and the choppy waters of 2022.

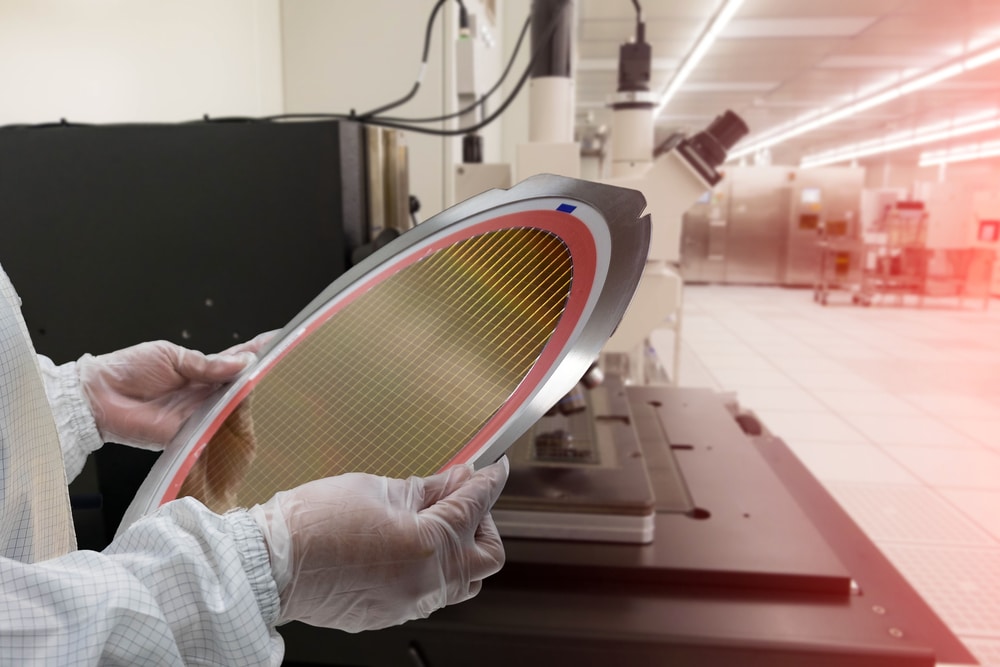

If you’d like to turn off the noise and add some stability to your life, ASML (NASDAQ: ASML) could be the bright idea you’ve been searching for. The company is the global leader in lithography – concentrating, focusing, and guiding ultraviolet light – which serves as one of the most important parts in the semiconductor manufacturing process.

Supply-constrained and with a flood of orders in backlog, ASML is gushing cash and is generously sharing it through repurchases and dividends. It is a moderate risk company, who is showing superior business economics yet is still exposed to geopolitical uncertainties. It’s an ideal pick for long-term investors who are interested in a profitable leader who will compound their capital for decades.